Spring Has Sprung The experts will tell you that springtime began on March 20th for those of us who live in the Northern Hemisphere. That’s the day each spring when the Sun shines directly on the equator and the day is evenly divided between day time and night time. Another way to think of this

February 2017 Recap

Wayne Gretzky, a National Hockey League Hall of Fame inductee, is probably the greatest hockey player of all time. He had a storied career even though he lacked overwhelming size or strength; in fact he was a good 30 pounds lighter than the average player of his time. On the ice, he showed great stamina

Student Debt Crisis —Part 2

This is Part Two of a two-part series on the Student Debt Crisis now facing America. In Part One, we looked at how bad the problem really is and how we got here. In this second installment, we’ll look at proposed fixes and how with some good planning you can avoid becoming a student loan

Student Debt Crisis —Part 1

This is Part One of a two-part series on the Student Debt Crisis now facing America. In this piece, we’ll look at how bad the problem really is and how we got here. In Part Two, we’ll look at proposed fixes and how with some good planning you can avoid or at least take steps

Roth 401k vs Traditional 401k, Which is Best?

Recently, there has been renewed discussion about whether employee investors should make traditional pre-tax contributions into their employer-provided 401k plan or take advantage of the Roth 401k option. Over the past several years, many employers have added a Roth 401k option to their retirement plan offering, which is the basis for the increased discussion. What

Tax Free? Does it Really Exist?

Most People Confuse Tax Deferred (will be taxed at some point) with Tax Free (will never be taxed) When most investors hear “tax free income”, they immediately think about investing in municipal bonds which are free from federal income taxation. There are many financial calculators for the tax free equivalent yield when investing in municipal

Tax Free? Does it Really Exist?

Most People Confuse Tax Deferred (will be taxed at some point) with Tax Free (will never be taxed) When most investors hear “tax free income”, they immediately think about investing in municipal bonds which are free from federal income taxation. There are many financial calculators for the tax free equivalent yield when investing in municipal

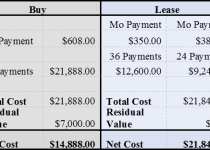

Buy or Lease that next car?

The old clunker sitting in the driveway is on its last leg, and you are trying to decide what’s next. You always see those commercials with the nice shiny brand new cars and the payments advertised seem reasonable until you realize most of them are for a lease. So, you are wondering if it makes

When diversification fails, have an exit strategy.

Investing has changed in recent years. Long gone are the good ole days of the '80s and '90s when stocks seemed to go up every day and all you had to do was buy one ... any stock. Or buy a share of the latest and greatest mutual fund. These products gained wide popularity during

March 2017 Recap

What a difference a year makes. Do you recall how 2016 started? The United States’ Federal Reserve announced the first interest rate hike in years in December of 2015, and the S&P 500 would then plummet almost 11% over the following 8 weeks. At the same time, Japan and a number of European countries initiated