The old clunker sitting in the driveway is on its last leg, and you are trying to decide what’s next. You always see those commercials with the nice shiny brand new cars and the payments advertised seem reasonable until you realize most of them are for a lease. So, you are wondering if it makes more sense to lease that next new car or buy it as you have in the past.

I get this question a lot, and it is always a difficult conversation. Why? Because most of the time, the person I’m talking to has not thought about what is most important to them. They haven’t really examined their lifestyle or decided what items to consider in the decision. But the short answer to whether it is better to lease or buy that next car is – it depends. It’s not possible to simply say that one is always better than the other. The answer depends on the specifics of each individual situation. The truth is, leasing a car is a great option for some people, but not for others. Let’s look at some of the questions we should be asking ourselves before we make the buy or lease decision.

- Which is more important: Driving a new car every two or three years with no major repair risk, or driving one vehicle for many years and assuming the responsibility for all maintenance after the warranty expires?

- Which is more important: Lower monthly payments, but higher long-term cost – or lower long-term costs but higher monthly payments?

- Do you drive no more than an “average” amount of miles in a year – or is your mileage highly unpredictable?

- Do you take good care of your cars and maintain them properly – or do you tend to be more lax about such things?

- Do you have a stable lifestyle and habits that will prevent you from wanting to, or needing to, end a lease early?

These are just a few of the questions that need to be answered before making this decision. Since buying a car is one of the biggest purchases you can make, it’s wise to look at all your options. Both leasing and buying have advantages and disadvantages, just like renting or buying a home. Having a clear understanding of what you want out of your vehicle can help lead you to the best decision.

The most obvious difference is that with a lease, you get a new car every few years with little or no hassle of maintenance, and you don’t have to deal with selling it or trading it in later. Just hand in the keys and get a new lease. However, if we are looking at what makes the most financial sense, then there are other factors to consider. One thing I tell clients all the time is there is a financial decision, and there is an emotional decision. Either can be right for different reasons at different times, but emotional decisions often win out because the financial factors are not considered as deeply.

I can say, however, that after looking at many lease programs and financing options over the years, there is a general underlying theme regarding the financial decision. That being, the longer you have the same car, the more you will save over time. That still does not make buying a car right for everyone. However, most data will show that buying a car is almost always cheaper in the long run over leasing.

One problem that arises when folks consider the buy vs. lease decision is that they feel they can get much more car by leasing than they can over buying. That is true if the only factor being considered is the monthly payment; however, comparisons need to be done on the same car. An apples to apples comparison doesn’t occur if you compare buying a $25,000 car to leasing a $40,000 car. If someone cannot afford to buy a particular car, they most likely don’t need to consider it for a lease simply because the payments are lower.

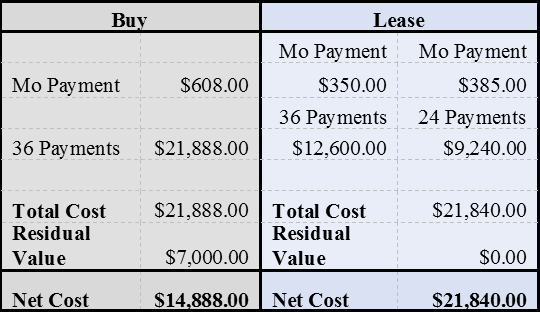

If you look at buying or leasing a $20,000 vehicle for five years, assuming a 6% rate on a new loan (paid off in three years), and two 3-year leases to cover the full five years.

In this quick example, the lease costs roughly an additional $1300 per year or just under $7000 over the full five-year period.

Chart Assumptions: 1) Normal driving with no additional overages in mileage, then we could avoid any additional mileage costs from the lease; 2) Leased vehicle in great shape so as to avoid any additional wear and tear charges at the end of the lease; 3) Car has a residual value of $7000 at the end of five years.

I realize that a new car every few years with no hassle of maintenance can be attractive to many, but if dollars and cents is the deciding factor, then owning a car for several years will leave more money in your pocket. Additionally, purchasing a low mileage used car, where the original owner took much of the depreciation hit, is an even more prudent decision to consider. However, if you plan on buying cars and flipping them every few years, leasing is more logical in that situation since so much of the depreciation occurs in the first few years.

There are many planners out there that will tell you never to finance a car for more than three years and never to lease a car. They will also tell you to keep a car for 10 to 15 years to get the full benefit of owning the car. The only catch is that’s not practical for everyone. For some people cars are more than just a financial decision.

The bottom line is - it’s personal. All of us have different personal styles, objectives and priorities – in cars, life and finances. Know your objectives and priorities, and the financial decision can match the emotional one.