Market Overview

This month’s models are now available. There are CHANGES in ALL the models. Changes are highlighted in YELLOW.

Work: Is it worth it anymore?

Would you believe Weekend at Bernie’s is almost 30 years old? We only mention it because this lighthearted summer comedy offers a message that’s just as timely today.

When the two buddies show up at their boss’s plush, beachfront chateau, The Serious One says: “All of this could be yours if you set your goals and work hard.”

When the two buddies show up at their boss’s plush, beachfront chateau, The Serious One says: “All of this could be yours if you set your goals and work hard.”

The Snarky One replies, “My old man worked hard. All they did was give him more work.”

Has anything really changed since 1989? Well, yes. The implication that labor is only for those without enough imagination to scheme is even more prevalent today, as the statistics bear out.

Best of times …?

The case can be made that the economy has rarely if ever been in a better position.

First of all, gross domestic product is experiencing healthy growth. The second quarter’s 4.1% is certainly great news.

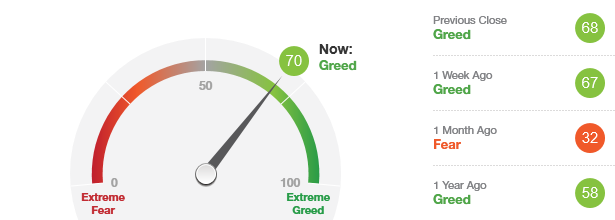

The stock market continues to hum a happy tune. The S&P 500 had an almost unprecedented year in 2017, growing 21.83% assuming reinvested dividends. A lot of market watchers thought that double-digit growth couldn’t happen two years in a row. But here we are, just over halfway through 2018, and year-to-date, the index is up 6.36%. If the market just maintains course and speed, it’ll coast into another very good year.

Unemployment is where it was during the dotcom boom or the Eisenhower years. At last reading, it stood at 4.0% of the civilian workforce. And, just as in those halcyon days, it’s well below the “natural” unemployment rate – the level that characterizes an otherwise efficient and expanding economy.

And yet …

… worst of times?

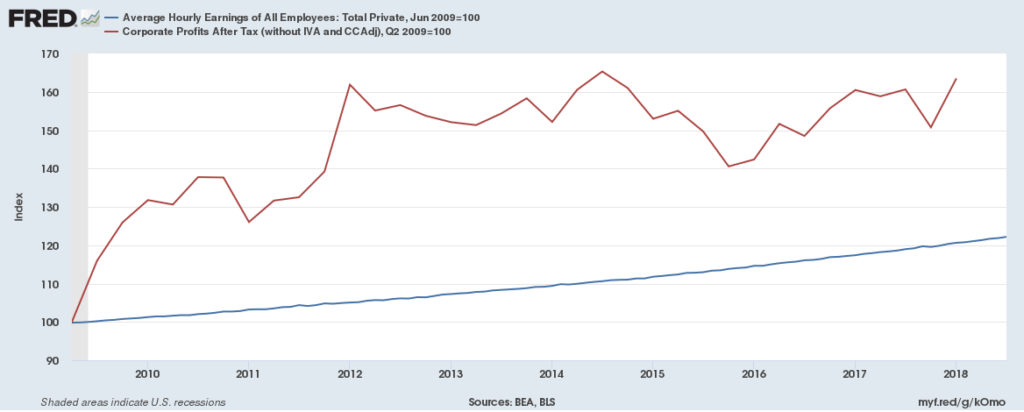

The average hourly wage in the U.S. is around $27, and has been growing at a fairly steady rate since before the Labor Department began tracking the series in 2006. Still, paychecks have been lagging far behind corporate earnings since the end of the Great Recession. Profits have actually grown three times as much as wages in that time.

Hourly wages vs. corporate profits, indexed to 2009

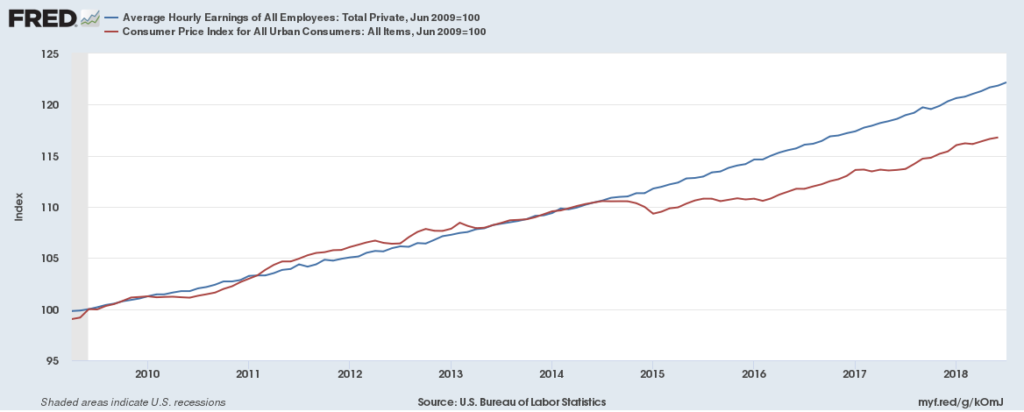

While it’s true that workers received a 22% raise over the course of the past nine years, they didn’t get to keep much of it. Inflation, as measured by the Consumer Price Index, almost evenly matched wage growth for much of that time. So hourly employees didn’t see any real pay hikes, on average, until late 2014. Wages have outpaced inflation since then but, nine years after emerging from the crisis, employees have seen only a 5% real pay raise.

Hourly wages vs. CPI, indexed to 2009

This is all the more puzzling because, as noted before, the unemployment rate is below what economists consider the healthy, “natural” level. That constitutes a labor shortage, which suggests that wages ought to be rising faster than inflation. One reasonable explanation would be that the workforce is increasing in number. Even though the percentage of unemployed people keeps going down, the actual number of unemployed people could still be going up.

But that’s not the case. As of June, the Labor Department reports that 62.7 million Americans participate in the civilian workforce. This figure has held steady for the past three years but, between the 2009 and 2015, it dropped by 5%.

Some of this has nothing to do with economics. A recent Pew Research Center study shows that teens have largely abandoned the rite of passage that was working a job at the mall. At the other end of the career spectrum, many older Baby Boomers took the financial crisis of 2008-2009 as a hint that maybe it was time to call it quits. As a result, the Social Security Administration reports there are only 2.8 Americans working for every Social Security beneficiary today. That’s down from 3.3 just before the crisis, and the trend isn’t expected to reverse in this century. The number of people working is dwindling compared to the number of people who have moved on to other pursuits. And Wisdom Tree makes the point that “1.4 million prime aged males are out of the work force because of opioid addiction,” a combination of lost productivity of impaired workers and the incarceration of offenders with no path back to employment.

So, although the 30,000-foot view of the economy looks like blue skies, we’re well advised to get another view from the ground. In preparing this article, we came across an interesting quote in a number of sources – enough that we hesitate to credit one individual with it. But here’s what 4.5 million web pages, according to Google, have to say as the last word on this topic:

“You can’t eat GDP.”