Market Overview

Collecting value, or collecting dust

One of humanity’s oldest customs is collecting things.

We’re told that Cro-Magnons collected gold in their caves 40,000 years ago. Interestingly, there's no proof that people worked with it as a material for tool making or artistic embellishment until about 8,000 years ago. But early humans valued it because it was shiny and rare and only later learned how to craft it. Its inherent value was as nominal then as it is now.

The same can now be said about artworks, wine, children’s toys, trading cards, vintage video games, comic books or military regalia.

Collecting is a natural thing to do. Who knows? Maybe it’s an instinct. If you find yourself surrounded with stamp or coin albums, that’s great. Indulge your obsession – you earned it.

If there’s any income to be made from your hobby, it’s all gravy. Just be careful not to spill any on your 1040.

Tax collecting

Usually, when someone wants to invest in something besides traditional holdings like stocks and bonds to fund their retirement, one of the best vehicles to use for these “alternative assets” is a self-directed IRA. This type of IRA is the only ERISA-qualified retirement plan that allows account holders – acting on their own without a fiduciary – to invest in things like real estate, hedge funds, private lending, private equity, precious metals, pork belly futures, carbon offsets, cryptocurrency, racehorses and so much more. The IRS draws the line, though, at collectibles.

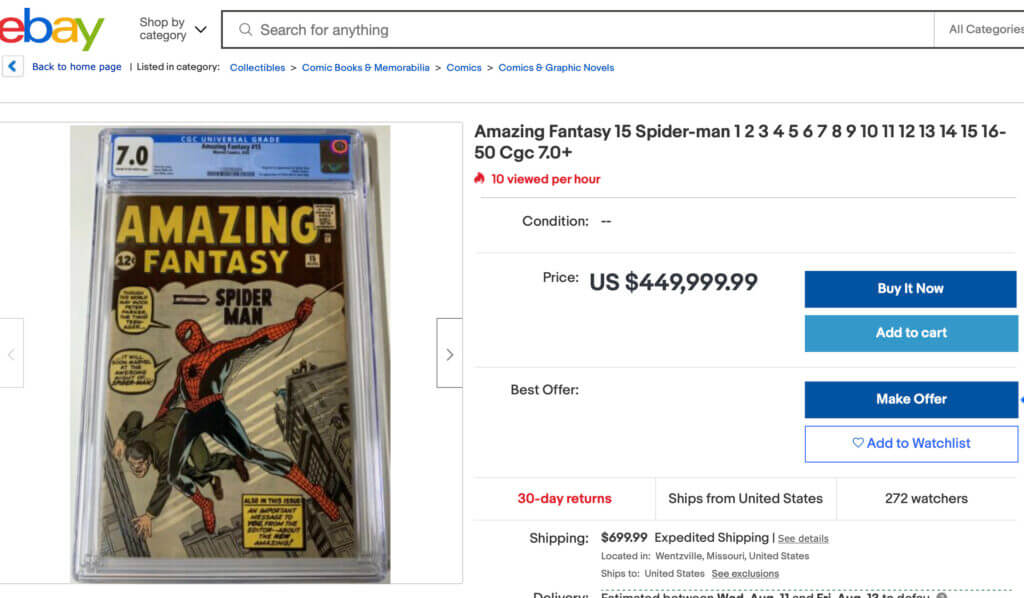

The entire reason to invest in any IRA, self-directed or otherwise, is its favorable tax treatment. That tax shield is not available to collectors who might have bought Amazing Fantasy No. 15 (first appearance of Spider-Man) for 12 cents then sold it for almost half a million dollars.

Thought we were kidding about the prices? Credit: Steve Ditko, Marvel Comics

But wait, it gets worse. Not only is there no tax benefit to collecting for fun and profit, there’s actually a tax penalty.

As a point of comparison, you would typically pay 15% on capital gains from an accretive sale of a block of marketable securities. But the Taxpayer Relief [sic] Act of 1997 is very specific about gains from collecting. That Spidey fan is going to end up giving 28% to the IRS. That’s practically double the capital gains tax. For so big a bite, one might just as well work for a living.

Hobbyist, meet Professional

While there is an exception for coins and precious metals, pretty much all other collectors are automatically at a disadvantage. On top of that, there is the 3.8% net investment income tax. The NIIT is often called the “Obamacare tax” because it passed in 2012 shortly after the Affordable Care Act with the intention of plugging some holes that were created in the federal budget. Broadly speaking, it applies to taxpayers with modified adjusted gross income exceeding $200,000.

How do you calculate modified adjusted gross income? Can you offset gains from collectible sales with losses? Who determines what constitutes a “collectible” and can that definition change capriciously? Most importantly: Are there any ways to avoid any of that 28% tax?

For answers to these and other questions, you should probably talk to a financial advisor – if you can pry him away from his garage full of Pokémon cards.