Market Overview

This month's models are now posted.

How to invest for Trump 2.0

Stock prices were likely to rise in November no matter who won the U.S. election because, whatever the outcome, a lot of uncertainty would be gone. That said, the resounding Republican victory – carrying both chambers of Congress as well as the White House – suggests that a business-friendly climate at both ends of Pennsylvania Avenue will prevail for at least two years. So, stock prices didn’t just go up – they soared.

Elections have consequences, and certain industries and even particular companies will benefit more from a second Trump Administration.

Here’s how we see it.

Industrial strength

Because of reduced environmental regulation, many expect oil-and-gas stocks to rise. We do too, because these stocks always do over time. We ran the numbers, and oil company share prices rose during the 12-year tandem of Ronald Reagan and George H.W. Bush, the eight years of Bill Clinton, the eight years of George W. Bush, the eight years of Barack Obama and the four years of Joe Biden. The only administration that left office with lower Energy sector market cap than it started with was the Donald Trump’s first term, but this can be attributed to the Covid pandemic. We anticipate that, absent an externality of that scale, “drill-baby-drill” will be back.

Deregulation is also a theme supporting investment in the Financial Services sector, with names in both the investment banking and commercial banking industries bandied about. We agree with this theory in broad terms but expect wins here to be tempered if interest rates start to fall. Of course, that will only happen if inflation remains in check. If the incoming administration follows through on its stated tariff policies, that might not be the case.

More likely to benefit from deregulation is the Health Care sector, particularly pharmaceutical makers and Medicare Advantage plans.

Even if tariffs drive up some prices, though, they will clearly protect some key industries. Semiconductors would be first in line to benefit. Next in line would probably be steel.

Another controversial policy that won the day on November 5 was a more accommodating approach to antitrust enforcement. This would tend to benefit the giants of the Information Technology sector. This new administration might also be good news for startups, considering that Vice President-elect JD Vance made his fortune in Silicon Valley’s venture capital community. Here’s a link to the portfolio of Narya Capital, the firm he founded.

Defense contractors tend to do well under Republican administrations, and we doubt a second Trump term will be the exception. Even so, much of the president-elect’s rhetoric suggests that the U.S. would dial back its military commitments abroad, so this remains far from certain.

At the top of every pundit’s list of industries that will surge during a second Trump presidency is for-profit prisons. We’re not so sanguine, though. These companies did well in the first couple years of Trump’s first term, but the rallies petered out after that.

Taken together, these don’t correlate with the business cycle. Health Care stocks tend to outperform during contractions while Technology stocks do so during market peaks. Financials are where many savvy investors rotate money to during rebounds while they often ride Energy shares late in the cycle.

Taking stock

Buying sector-specific funds has its risks, but picking individual stocks is even more so. That said, it pays to know what companies the Trump entourage is most closely aligned with.

The first one that comes to mind is Trump Media & Technology Group (Nasdaq: DJT), majority-owned by the man himself. We all figured its price would spike after the election, but we were wrong. During the previous month, it rose from a near-record low to the mid-$30s, where it has been stuck ever since. While this is far from its 52-week low of $11.75, it’s even farther from its $79.38 52-week high. Its fundamentals may be weak, but Trump Media was never going to trade on fundamentals. The company is, however, bait for a friendly takeover. One journalist on CNBC alluded to “people who might want to curry favor with the administration just coming in with a giant offer.” She mentioned Elon Musk by name, because he owns social media platform X, which would have a strategic interest in Trump Media.

Speaking of Musk, let’s remember that he is CEO of electric vehicle maker Tesla (Nasdaq:TSLA). That’s in addition to his roles in the Trump campaign and the incoming administration. Three privately held companies, space technology leader SpaceX, transit system builder The Boring Company and brain-computer interface developer Neuralink, round out his portfolio. And even though Musk exited his position in OpenAI, he still has extensive interest in artificial intelligence.

Donald Trump, Jr., will not be reprising his role in the incoming administration. Still, he has been making headlines lately by joining corporate boards. The day after Biden essentially legalized influence peddling for presidential sons, Don Jr. joined the board of digital marketplace PublicSquare (NYSE:PSQH), a microcap that saw its stock price triple on the news. A few days earlier, the president-elect’s eldest son acceded to the advisory board of drone maker Unusual Machines (NYSE:UMAC), another microcap.

Treasury Secretary-designate Scott Bessent is a fascinating pick. He has his share of conservative credentials: South Carolinian, church-going billionaire who preserves landmarks of the antebellum South. But there’s a lot about him that appeals to liberals: George Soros protégé, donated to the previous three Democratic presidential candidates, gay. What’s undeniable about Bessent is that he’s qualified for the job. He made his fortune in the currency market, so we wouldn’t bet against the dollar for the next four years.

Class in session

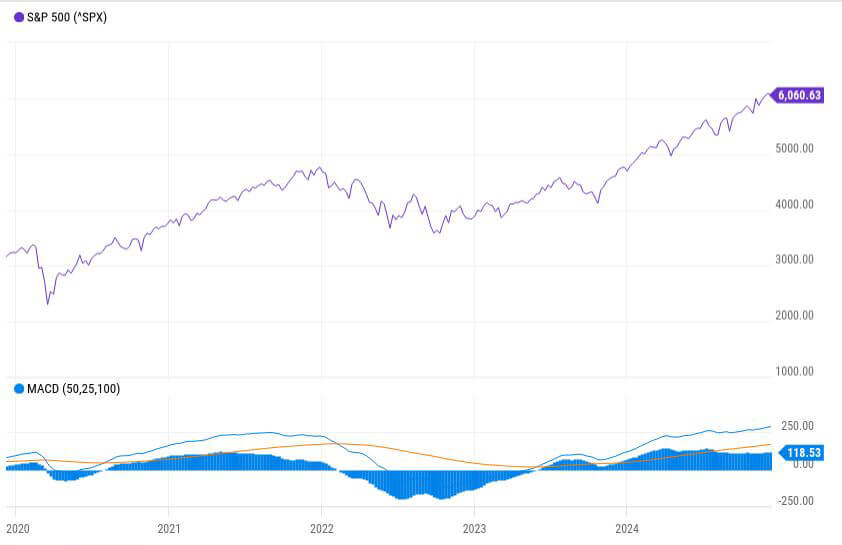

The lower corporate tax rate called for by the incoming administration is bound to be welcomed by companies across all sectors, and Goldman Sachs expects the broader U.S. stock market to gain 9% over the next 12 months.

Stocks, though, are not the only asset class to consider. Lower interest rates might be expected but they haven’t gotten here yet, so bonds remain a compelling story. Further, the dollar keeps strengthening against all comers in the currency markets.

Also, cryptocurrency has taken off like never before – and that’s saying something. Trump-adjacent interests have actually launched their own token, World Liberty Financial.

The failure of all this analysis, though, is that it’s based on stated positions. There has always been daylight between what Donald Trump says and what he does. Only time will tell how much daylight will shine from now through 2028. So, stay in touch with a financial advisor who has earned your trust through Republican administrations and Democratic ones, through good times and bad.