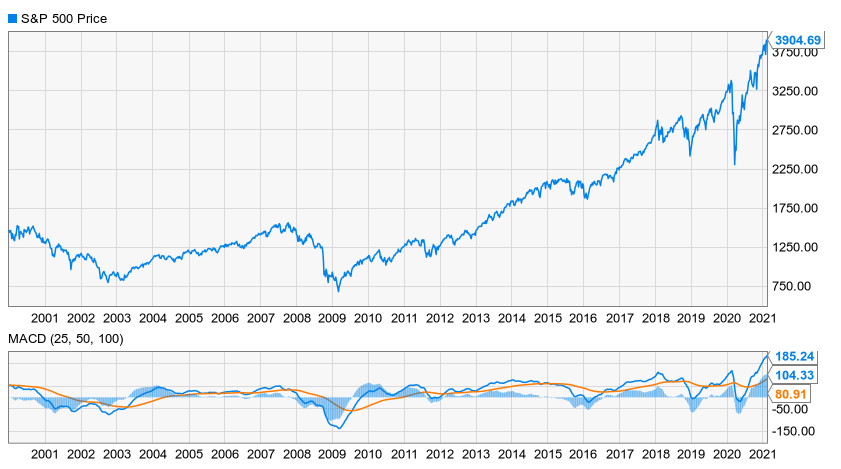

Market Overview

Investing well by investing good

Over the past two or three years, many investors have focused more on companies’ performance in terms of a new set of standards, those of the Environmental, Social and Governance movement. ESG might sound like something that appeals strictly to yoga instructors and vegan coffeehouse staff, but that is an outdated view. Sustainability – a term many prefer to ESG – has some very straightlaced boosters on Wall Street.

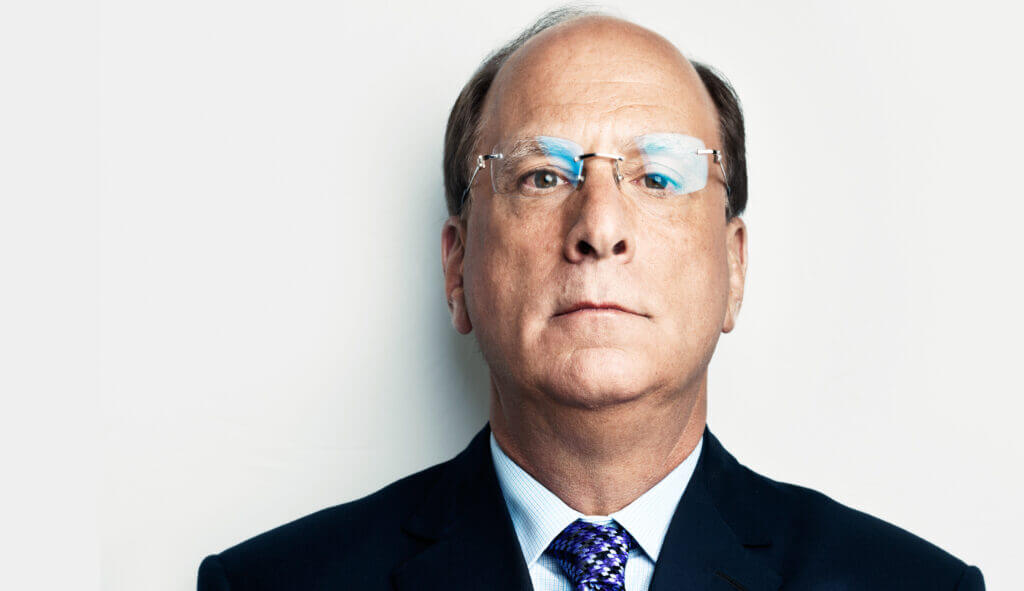

“From January through November 2020, investors in mutual funds and ETFs invested $288 billion globally in sustainable assets, a 96% increase over the whole of 2019,” according to Larry Fink, CEO of BlackRock, the world’s largest asset manager. “I believe that this is the beginning of a long but rapidly accelerating transition – one that will unfold over many years and reshape asset prices of every type.”

The case for ESG

There are three strong reasons for the strong growth. First, ESG investing is inherently less risky than committing funds without considering sustainability.

“The most compelling reason to consider ESG in the investing process is risk mitigation,” according to the sustainability report for private equity firm Paine Schwartz Partners. “These risks are frequently unquantified, but that is often because they have not yet captured the attention of credit rating agencies.”

Specifically, when a company analyzes its ESG exposures, it can uncover regulatory, remediation, legal liability and reputational risks that it might not otherwise identify. Once identified, they can be managed.

Second, ESG funds tend to outperform the wider market. That’s the conclusion of a 10-year Morningstar study cited in the Financial Times and other outlets. There are caveats, of course. For instance, ESG funds tend not to invest in oil companies, which have been a drag on the indexes of late. At the very least, though, it’s reasonable to conclude there’s no penalty to investing in companies which take sustainability seriously.

Third, ESG investing is likely to have air cover from the new administration in Washington. While we could just assume that’s true – this all sounds like Democratic talking points after all – there’s something more concrete here. If you read this space in December, then you know the name Brian Deese, President Biden’s National Economic Council director. But there’s one thing we didn’t mention about him. You know what Deese’s previous job was? He was head of sustainable investing at BlackRock. That’s right: The guy who produced the report Fink cited above now has an office in the West Wing.

Larry Fink: Risk-averse capitalist, granola-crunching hippie or both? Credit: Fortune

Defining ESG

But what is this ESG thing all about? Sounds a little squishy. And it is, but not as much as many assume.

The root is a series of 17 objectives the United Nations enumerated in 2015 as its sustainable development goals. Some people are under the impression that these all have something directly to do with environmental issues. Several do, but it’s broader than that.

Sustainable development goals. Source: United Nations

Still, the “E” in ESG is for “environmental,” but it’s not touchy-feely, tree-hugger stuff. It’s more empirical than that. Take for example No. 6, Clean Water and Sanitation. Recycled water can be measured by the cubic meter. Similarly the number of metric tonnes of greenhouse gas emissions reduced year-over-year by a company informs No. 13, Climate Action.

“Social,” the “S,” is much more qualitative. The money a company donates to charitable organizations and the time its managers and employees dedicate to volunteer activities go a long way toward achieving pretty much any of the 17 goals.

“G” for “Governance” is concerned with the company’s workplace. Women as a percentage of the work force – better yet, as a percentage of management – is an indicator for how well a company is doing in connection with No. 5, Gender Equality. Similarly, No. 10, Reduced Inequalities, has received increased scrutiny worldwide in the wake of last summer’s Black Lives Matter movement.

Ultimately, none of this demands radically new behavior from well-run companies. Do they seek to avoid litigation and fines due to faulty products or processes? Do they try to behave like responsible corporate citizens, at least for the cameras? Do they agree with the studies out of Harvard University, Google, the Journal of Management, the Boston Consulting Group, McKinsey & Co. and a slew of other institutions that conclude diversity leads to better decision making? If so, an ESG fund’s investment committee might be looking at them right now.

And maybe you should be looking at ESG funds. Each one is a little different, and not just in their annual returns. Some emphasize E more, others S, others G. So there’s bound to be one that meets your own preferences as well as your financial objectives. Maybe it would be a good idea to put a suitable amount of your retirement portfolio in one, or maybe it would suit you better to expose just your philanthropic endeavors to a specific ESG fund. Like any financial decision, it can get complicated pretty quickly. Perhaps you should talk to an investment advisor about this trending area in the financial world.