Market Overview

This month's newsletter has been posted. There are NO CHANGES in any of the models.

Moving the chains: Crypto gets a new set of downs

Super Bowl LVII was that rare occasion when the game was more interesting than the ads.

Remember last year’s Super Bowl commercials? How many of them were for cryptocurrency exchanges or related entities? eToro, Crypto.com, Coinbase’s bouncing QR code … none of them aged well. Most embarrassing of all, though, was comedian Larry David’s pitch for FTX.

“… and the money you invest in FTX goes in this end.” Credit: Dentsu McgarryBowen

The name of the spot was “Don’t Miss Out,” and that was the whole point. Forget about crypto use cases. Who cares about fundamentals? How do you even arrive at a valuation? None of that’s important. All that matters is this: Taking a pass on crypto is like taking a pass on the light bulb, the wheel or indoor plumbing.

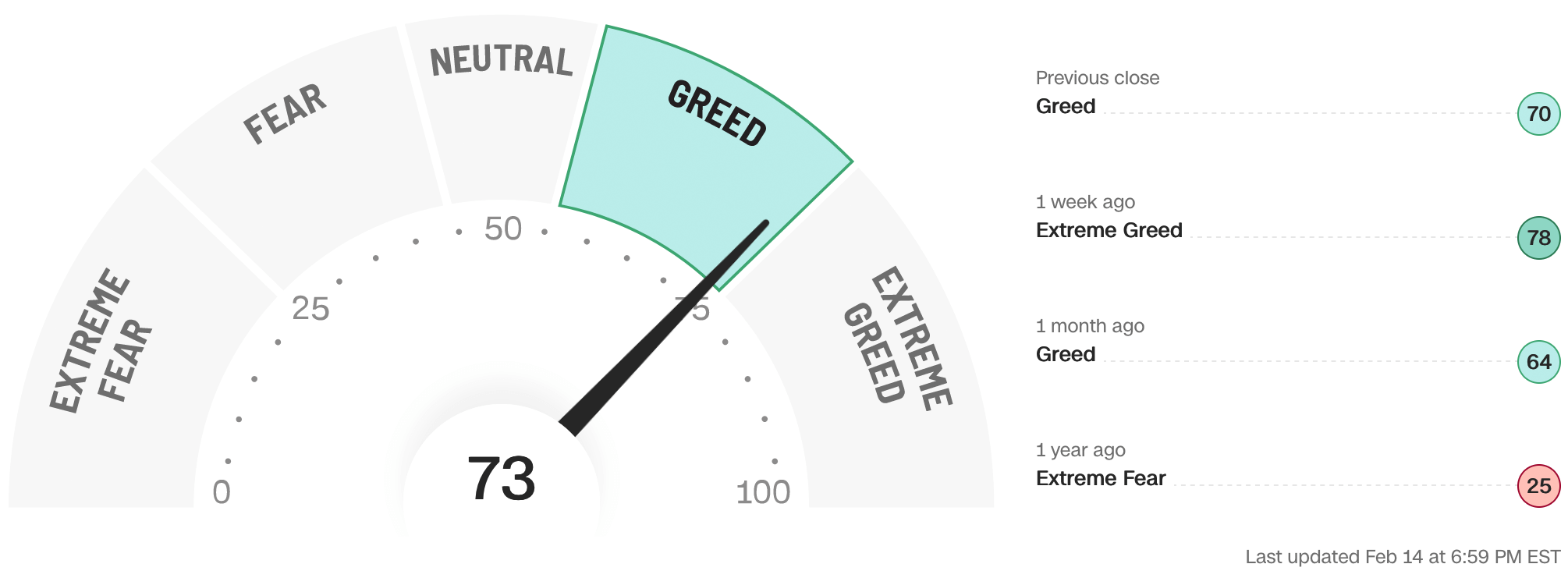

There were no blockchain ads on Super Sunday this year, but that doesn’t mean the entire asset class has gone away. It suffered from the latest of a string of “crypto winters” but appears to be recovering. It just doesn’t play well in cold weather. Dallas Cowboys fans know what that’s like.

Frozen assets

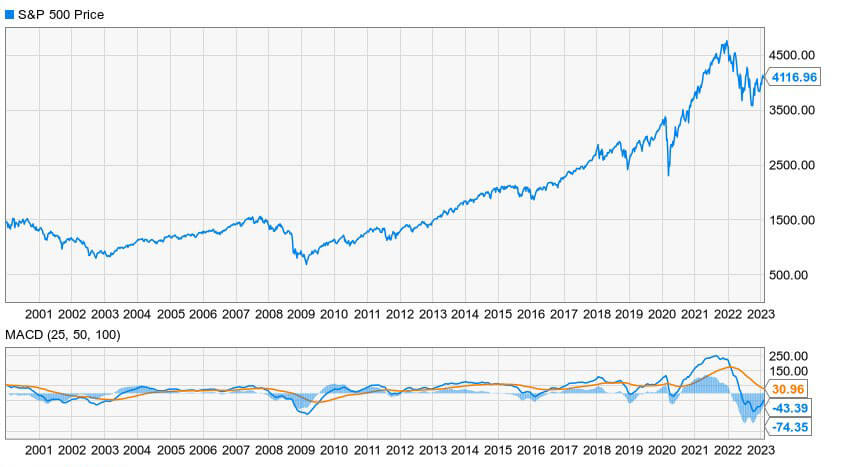

The term “crypto winter” originally referred to a period from mid-December 2017 to late March 2018 when Bitcoin Core, after a yearlong bull run, lost almost two-thirds of its value. The price of the most widely traded token steadied but then, come November 2018, it tanked again and stayed down until, once more, the market thawed in late March. It looked like Bitcoin was going to weather the winter of 2019-2020 fairly well, but then came Covid-19. Still, by the end of 2020, Bitcoin was trading at $40,000, and it just kept running. At its peak – mid-November of course, 2021 – it was closing in on $69,000.

By the time of the 2022 Super Bowl, Bitcoin had given up all its 2021 gains and was back to the $40,000 neighborhood. Of course, there were a lot of people – including FTX CEO Sam Bankman-Fried – who’d advise you to buy on the dip.

Today, Bitcoin is trading around $23,000, which is still higher than it was at the run-up to that first crypto winter.

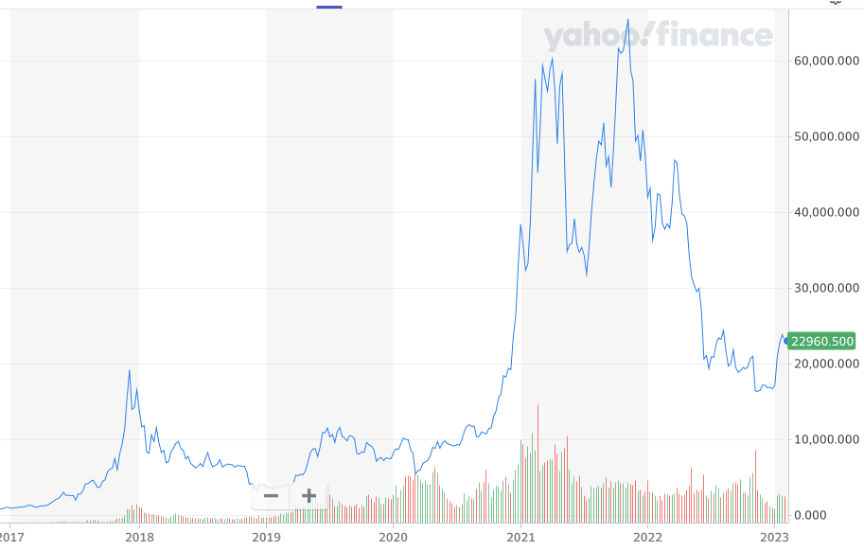

Let’s sketch that out with a fever chart:

Bitcoin’s series of crypto winters, linear view. Credit: Yahoo Finance

Bitcoin has a way of getting knocked down, but not out. Still, maybe this isn’t the best way to understand Bitcoin’s dynamics. Let’s look at it from the logarithmic view – that is, a chart where there’s equal space between $10, $100 and $1,000, rather than equal space between $10, $11 and $12. The log scale helps us visualize percentage change more clearly.

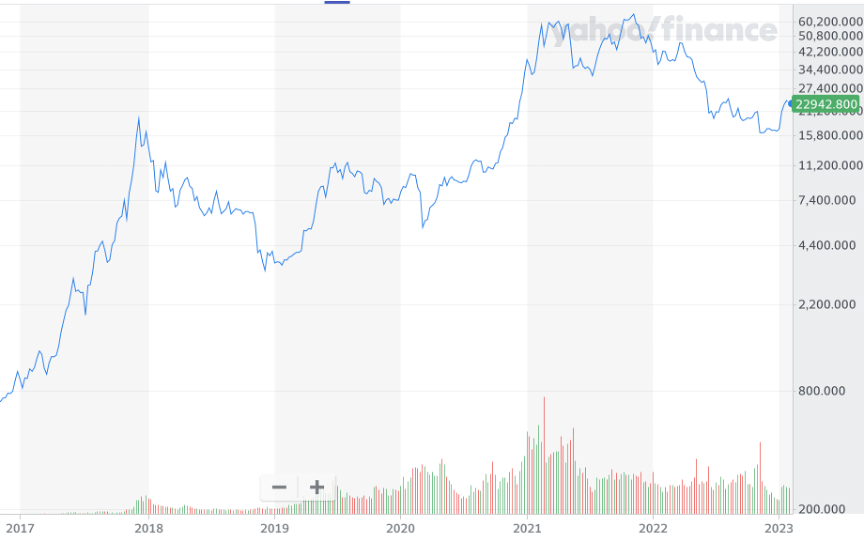

Bitcoin’s series of crypto winters, log view. Credit: Yahoo Finance

From this perspective, it looks more like Bitcoin rises fast, ratchets up, falls back and regroups, over and over again.

Sometimes there’s a concrete reason for it. Sometimes there isn’t. The first crypto winter was just a matter of irrational exuberance. The market was simply oversold.

But then you sometimes get an external shock, such as the collapse of FTX.

In Math Nerds We Trust

The dollar isn’t backed by anything real. It’s just a note written against the full faith and credit of the U.S. government. But we’re not seeing much of either lately. A University of California study tracked 50 years of Gallup and Harris polling showing how the American people have lost faith in institutions across the board, and government institutions specifically. Then all you have to do is tune in to the debt ceiling fight now going on in Congress to call the nation’s credit into question.

People can be forgiven for thinking that just maybe there’s a better way to imagine money. And that’s why we editors of this newsletter are not as dismissive of crypto as are a lot of people in the financial services industry. But even so, we all must put our collective faith in something or someone.

For a lot of crypto enthusiasts, that person was Bankman-Fried. Literally born on the Stanford University campus, he spent his high school summers at math camp then went off to college at MIT. He then went to work for Jane Street Capital where his job was buying and selling international exchange-traded funds. While there, he figured out how to take advantage of the widely known fact that cryptocurrencies tend to trade at different price points on different exchanges. So, he ditched Jane Street and opened up Alameda Research.

That’s where Bankman-Fried realized that, as much money as there is to make in crypto arbitrage, there’s more to be made by owning an exchange. So, he set up FTX.

We’re not saying it was a scam from the start, but let’s break it down. First, FTX was substantively owned by Bankman-Fried and run like a one-man show with a board of crony directors. Second, it was based in the Bahamas and incorporated in Antigua and Barbuda – as one does when one believes it’s easier to skirt U.S. regulations than to adhere to them. Third, it was intrinsically connected with Alameda Research – which was also incorporated offshore. If there’s one thing a quantitative trading firm that thrives on volatility is known to do, it’s posting short-term losses. Alameda’s entire model is high risk, high reward. With nobody looking at the relationship between the exchange and its leading market maker, and all internal accounts denominated in the FTT token that drew its value directly from FTX, shenanigans inevitably ensued. It was just a matter of when and how blatantly. And as soon as the crypto market deflated enough that Alameda needed funds to cover ill-advised positions, those shenanigans quickly ran into the billions of dollars. FTX went bankrupt, investors’ money evaporated and Bankman-Fried was extradited to the U.S. to face fraud charges.

Larry David is hilarious, but maybe we shouldn’t have been taking investment advice from him.

The point after

In the wake of FTX’s collapse, just as in the first crypto winter, Bitcoin lost two-thirds of its value. And then – this is the important part – it recovered. As goofy an idea as cryptocurrency may seem to some, it apparently has some inherent value or it wouldn’t keep rebounding like this.

Of course, FTX is not the only place to trade crypto. At least one other crypto exchange, Coinbase, endeavors to be treated like any other American financial services provider and strives to stay inside the lines of compliance. It’s having its struggles at the moment, but so’s the whole tech sector. And Binance, the world’s largest crypto exchange, has a U.S. unit that also takes pains to stay in Washington’s good graces.

We should also note that FTX wasn’t the first crypto exchange to go belly-up. In 2014, Tokyo-based Mt. Gox handled 70% of all Bitcoin transactions worldwide – until suddenly it didn’t. Was its liquidation forced by theft? Trading losses? Managerial incompetence? It was probably a mix of several factors and we’ll never know the precise proportions. We can only be guided by Hanlon’s razor: "Never attribute to malice that which is adequately explained by stupidity." You might have guessed by now the effect the Mt. Gox fiasco had on the price of Bitcoin: down by two-thirds, followed by a recovery that soared to new highs.

Is Bitcoin fated to bounce out of this trough? Is a six-digit valuation inevitable? And what about Ethereum, XRP or any of the other cryptocurrencies that remain relevant players in the crypto universe? For that matter, are non-fungible tokens, or NTFs, a fad that has passed or will they be making a comeback as well? Nobody knows for sure, but a trusted financial advisor could help you design a playbook to handle any contingency.