Market Overview

On a year-to-date basis the S&P 500 is up 3.7%, the DJII rose 4.4% and the NASDAQ Composite is up 3.3%, all hitting record highs over the last week. All model portfolios remain well-diversified, therefore there are NO CHANGES.

2025 -Continuing the Trend

So far in 2025, US equity markets have demonstrated notable strength, with major indices again record highs during the run-up of the last two weeks. Investors are expressing optimism regarding the new administration's policies, anticipating that deregulation and support for dealmaking will bolster economic growth. This sentiment has been particularly beneficial for technology stocks, as some big players announced substantial investments in artificial intelligence infrastructure, leading to notable gains for firms like Oracle (ORCL) and Nvidia (NVDA).

Global markets have mirrored this positive trend. The Vanguard Total World Stock ETF, for example, has risen for nine consecutive days, its longest winning streak since 2008. However, analysts advise caution - regarding volatile government bond markets and the high valuation of US stocks relative to bonds. Rising US 10-year Treasury yields pose a potential risk to various asset classes - leading some to suggest that more modest equity gains of around 5-10% may be more realistic for 2025 vs the supercharged growth over the previous few years.

European stocks have also reached record highs, outperforming so far in 2025. Gains have been supported by improving eurozone growth, easing energy prices, and strong performance in industrials, financials, and energy sectors. While valuations remain lower than US equities, fiscal reforms and supportive monetary policies add to the region's appeal. Risks include geopolitical tensions and global demand slowdowns, but Europe offers attractive opportunities for value-focused investors.

In summary, equity markets have started 2025 on a strong note, fueled by investor optimism and positive economic indicators. Nonetheless, potential risks such as rising bond yields and high stock valuations warrant careful monitoring.

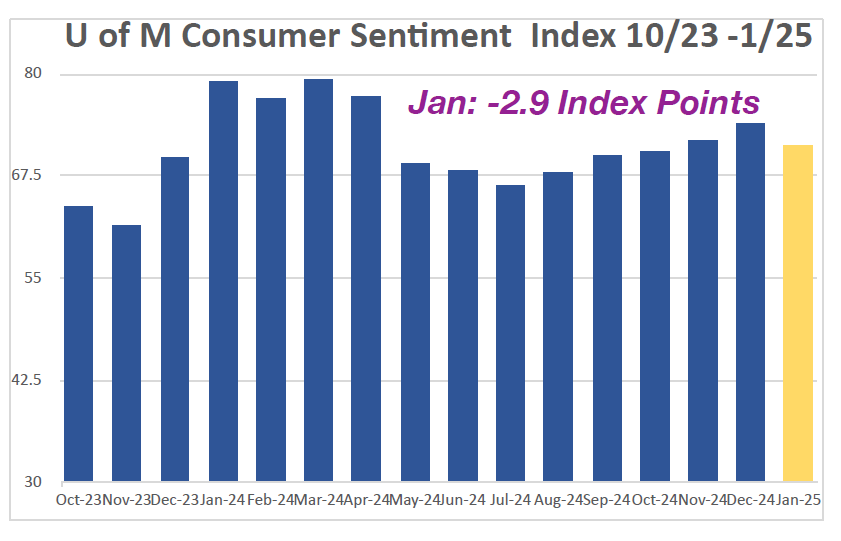

Index of Consumer Sentiment

January’s US Consumer Sentiment, as measured by the University of Michigan’s Index, fell for the first time in six months, edging down 4% from 74.1 to 71.1 index points. Sentiment declines were broad-based and seen across all incomes, wealth, and age groups. Reasons cited include concerns about unemployment (~47% of respondents expect unemployment to rise in the year ahead) and inflation (go-fwd inflation) expectations jumped to 3.3% from 2.8% last month, the highest since May 2024, mainly due to anticipated government policies such as a new tariff regime.

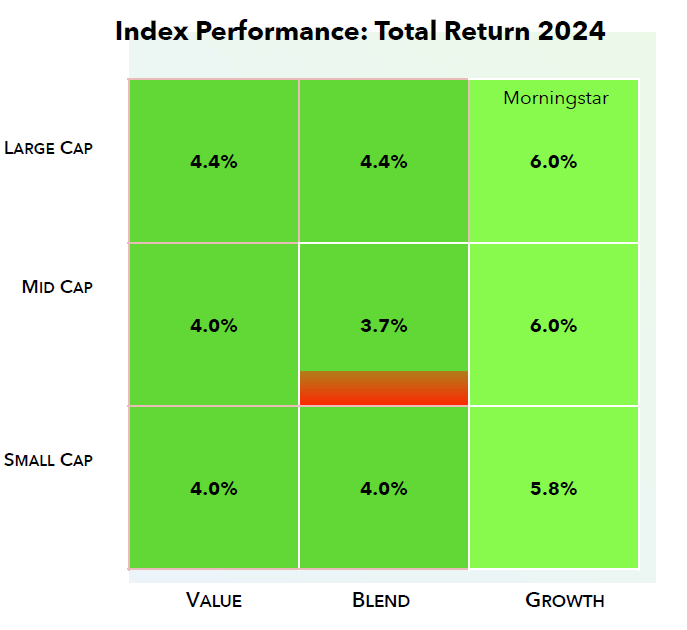

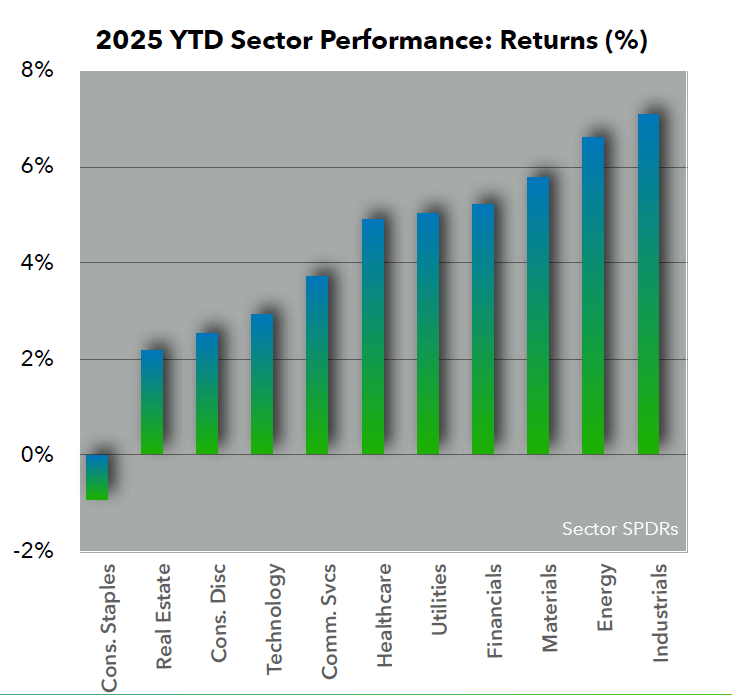

Index and Sector Analysis:

Indices: Once again and similar to 2024, growth quadrants outperformed the rest of the market. All index quadrants ended up in positive territory, with the lowest performing being mid-cap Blend.

Sectors: As mentioned above and on the previous page, US equity markets started the year strongly. The winning sectors were Industrials +7.1%, (mainly due to General Electric (GE) earnings beat and subsequent investor demand), Energy (+6.6% reflecting the outlook on global oil prices, on which Citibank just raised its 2025 estimate) and Materials (+5.8% with help from China’s recent reported growth. The clear laggard is Consumer Staples, which is likely due to both tariff concerns as well as expectations of certain policies that may be put forth by RFK Jr. (if confirmed as Secretary of HHS).

Fixed Income

So far in 2025, the domestic fixed income markets experienced notable developments influenced by various economic factors and policy decisions.

Reaction to Monetary Policy: The US Federal Reserve continued its easing cycle, reducing the Federal Funds Rate by 50 basis points in September and an additional 25 basis points in both November & December. However, in a counterintuitive response to these rate cuts, Treasury yields have risen sharply: the 10-year yield has increased by approximately 90 basis points since September, closing at 4.617% this month. Meanwhile, the 2-year yield has declined slightly to 4.263%, reflecting a steepening yield curve. This divergence highlights investors’ concerns about potential inflationary pressures stemming from proposed fiscal policies, including tariffs, immigration restrictions, and tax cuts.

Inflation and Fiscal Policies: The incoming administration's policy proposals have heightened inflation expectations. Analysts from major asset management firms anticipate that these policies could lead to prolonged price pressures, keeping inflation above the Federal Reserve's 2% target throughout 2025. Some of the policies in question concern increased tariffs on imported products from countries such as China, Canada and Mexico, threatened deportation of migrants, expansionary government spending on infrastructure projects and subsidies for domestic manufacturing industries.

Global Central Bank Actions: Internationally, central banks are also adjusting their monetary policies in response to evolving economic conditions. The Bank of Japan, for example, increased its short-term policy rate from 0.25% to 0.5%, the highest level since the 2008 financial crisis. This move reflects confidence that rising wages will keep inflation near the BOJ’s 2% target.

Investor Sentiment and Market Outlook: Despite recent underperformance, bonds are attracting renewed interest due to higher yields. Historical data shows that yields around 4.6% (such as the current 10-year Treasury yield), often lead to positive total returns for fixed income investors. This is prompting a reassessment of bonds as an attractive investment option in a complex and shifting macroeconomic environment. With a finite investment pool, the more competition that equities have for the investor dollar could lead to stock price pressure.

In Summary:

The fixed income markets in early 2025 are navigating a complex environment shaped by policy shifts, inflation concerns, and external factors. We advise investors to remain vigilant, focusing on diversification to manage potential risks while taking advantage of emerging opportunities in the bond market.

Bank Earnings

Financials have posted better than expected earnings for Q4 and the full year 2024. For example, Morgan Stanley (MS) beat Q4 estimates as the firm’s fixed income and equities trading ops greatly exceeded expectations - revenue rose 26% and quarterly profit more than doubled to $3.7 billion from a year earlier from higher activity in credit and commodities markets and increased strength in MS’ prime brokerage business that caters to hedge funds.

Similarly Goldman Sachs (GS) posted better than expected revenue and profit, based on trading revenue.

Corporate Earnings

Earnings Scorecard: For Q4 2024 (with 16% of S&P 500 companies reporting actual results), 80% of the reporting companies reported a positive EPS surprise and 62% reported a positive revenue surprise.

Earnings Growth: For Q4 2024, the blended (Y-o-Y) earnings growth rate for the S&P 500 is 12.7%. If this is the actual growth rate for the quarter, it will be the S&P’s highest (Y-o-Y) quarterly earnings growth rate since Q4 2021.

Valuation: The forward 12-month P/E ratio for the S&P 500 is 22.2. This P/E ratio is above the 5-year average (19.7) and above the 10-year average (18.2).