Market Overview

This month's models have been posted. The rest of the newsletter should be posted by mid-month.

Information Regarding Fund Selection

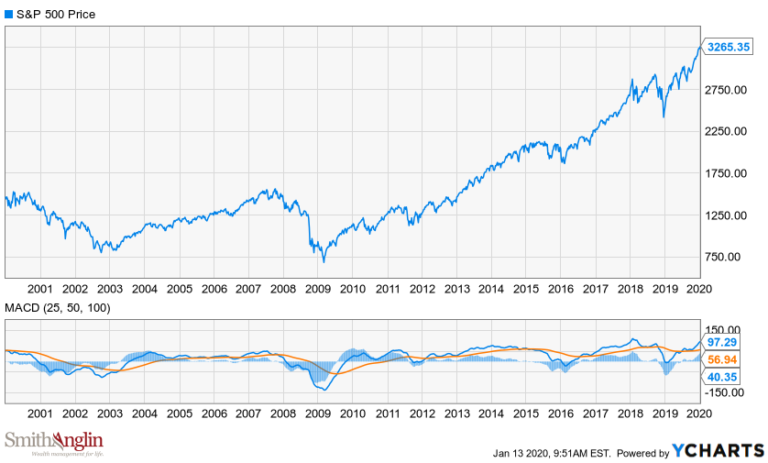

Over the last few months we have been asked to give a quick reminder of the process for picking the funds used in the USPFA models. Although it is somewhat technical in nature, the process is consistent and provides some clarity in the momentum between funds relative to each other. Since momentum is based on patterns over time, the models try to capture momentum to the upside and exit positions that have slowing momentum. Obviously, the longer the trends stay in place the better for upside positioning however, the process leans towards mitigating risk in periods of higher volatility.

When selecting the funds, we calculate the rate of change over various time frames to get a composite score for rate of change. We then apply the relative strength index over the last month of all the available funds and then rank each fund relative to each other, which provides another score. Lastly, we then apply M14 indexing (momentum over shorter periods) to each fund and multiply that result by a consistent factor. After those three calculations are known, we add them all together for a composite score for all available funds or indexes in your plan. In the conservative and moderate models, we use the top 4 positions in composite scoring, although they are weighted slightly different and the conservative model holds a larger allocation to money markets/stable value to reduce volatility. The aggressive models use the top three results from composite scoring plus a smaller allocation to cash or cash equivalents.

Inflation makes a comeback

It’s hard to get nostalgic about the 1970s. We remember what we wore, how we had our hair done up and the stupor-inducing sitcoms we considered appointment TV. And we also remember the way the economy was going.

As we noted in this space last decade, the 1970s’ economy wasn’t bad per se, but it was a disappointment – a ‘’bummer” if you will – following the 1950s and 1960s. Growth slowed, but it was still faster than it is today. And while the basic elements of supply and demand were more or less in balance for goods, services and labor, inflation ate away at wages and savings.

There were plenty of reasons why inflation was running so hot. The monetary policy adopted by the Federal Reserve was, according to one academic, “in disarray” as it tried to tamp down prices without throwing millions out of work. The Federal budget deficit was out of control, putting upward pressure on interest rates. And Washington stumbled its way into Mideast crises heedless of repercussions for the price of oil and downstream products.

Uh oh.

Can’t Buy a Thrill

Before we get too unsettled, a little inflation is a good thing. It suggests that wages are going up, which in turn suggests that labor is in demand, which itself indicates that people feel secure in their jobs, so consumer confidence is high. Consumer purchases account for almost two-thirds of economic activity in the U.S., so that’s a net positive. A little inflation also means that investors can reasonably expect that the money they put into ventures today will pay off bigger tomorrow, so more and bigger projects end up getting funded.

But there’s endless discussion on how to measure it. The most frequently cited is the Consumer Price Index for All Urban Consumers: All Items Less Food and Energy (core CPI). The Labor Department computes it to account for price changes affecting the 80% of Americans who live in places with populations exceeding 2,500, who don’t currently serve in the military and who aren’t in jail.

Core CPI tracks the cost of a market basket of products. Food and energy are excluded because they have the most volatile prices; a hard frost in Florida or a military dustup in an OPEC member nation would cause a spike.

But what does it actually track? When you realize that this statistic has been kept for a hundred years, you have to wonder if our buying habits have changed since the days when telephones and vacuum cleaners were status symbols.

The general categories remain the same, though: housing, apparel, transportation, health care, recreation, education, communications and personal goods and services. The broader measure of CPI also includes food, although box-subscription meals have replaced salted pork and cornmeal mush. Similarly, bituminous coal has since ceded market share to ethanol.

These don’t all rise – or fall – in tandem. Prices for cars and clothes remain fairly stable, while those for mobile phones, computer software and other new advents actually fall year-over-year. Housing and food costs have a way of rising over time, but not as fast as wages. Health care and education expenses, though, shoot through the moon. In the aggregate, according to recent CPI readings, prices are not currently rising as quickly as wages are. That is, as long as you don’t have a kid with asthma who wants to go to college.

Rumours

There are only two problems with core CPI: 1) Nobody really believes it anymore, and 2) It’s useless.

Nobody believes it because, first of all, it’s based on rather questionable data. Survey respondents keep a “diary” of their expenditures in order to establish the market basket’s components. If that were his idea of consumer data, Amazon founder Jeff Bezos would still be a middling product manager at Bankers Trust.

That the market basket changed over time is to be expected. Everything that lasts changes constantly, from the stocks that comprise the Dow 30 to the cast of DC’s Legends of Tomorrow. But selecting and weighting the changes is at least as much art as science, and as much politics as art.

What exactly is the result of all that art, science and politics is open to interpretation. There have been at least four major reviews of core CPI over its history and each was critical of how effective it was at measuring changes in the cost of living. One, 1995’s Boskin Commission, found that the index overestimated annual inflation by at least 1 percentage point, mainly because of slow adjustments to new consumer products.

Here’s where the politics comes in. Boskin worked for the Senate Finance Committee, controlled by the Republican Party at the time. Many taxes and transfer payments take their cost-of-living adjustment (COLA) cues from core CPI and, if it’s considered overstated, that means taxes and entitlements are going up faster than they ought. While it’s very much on-brand for GOP senators to tamp down taxes and entitlements, they also had a willing partner in the White House. Though a Democrat, Bill Clinton wanted to be remembered for working across the aisle, getting welfare reform done and balancing the budget. (He did all three but, alas, that’s not what he’s remembered for.) New methods for calculating core CPI were adopted as a result.

As you can imagine, these changes caused an uproar on the left. While some of Boskin’s criticisms were undeniably sound – in the Information Age, the market basket ought to be updated every couple years rather than every decade – some were controversial. If the cost of one good goes up but the cost of a substitute stays where it is, consumers will buy more of the substitute. Boskin believed that the index ought to consider that change in behavior and switch to measuring purchases of the substitute. But there are usually reasons why people selected one item over the other in the first place, and settling for a substitute could be seen as an erosion in the consumer’s standard of living. According to some critics, if today’s core CPI were measured by pre-Boskin standards, it would be somewhere around 7% per year.

As currently measured, though, it’s 2.3%, about where it was when Clinton left office, and less than one percentage point lower than it was before the Boskin Commission was empaneled.

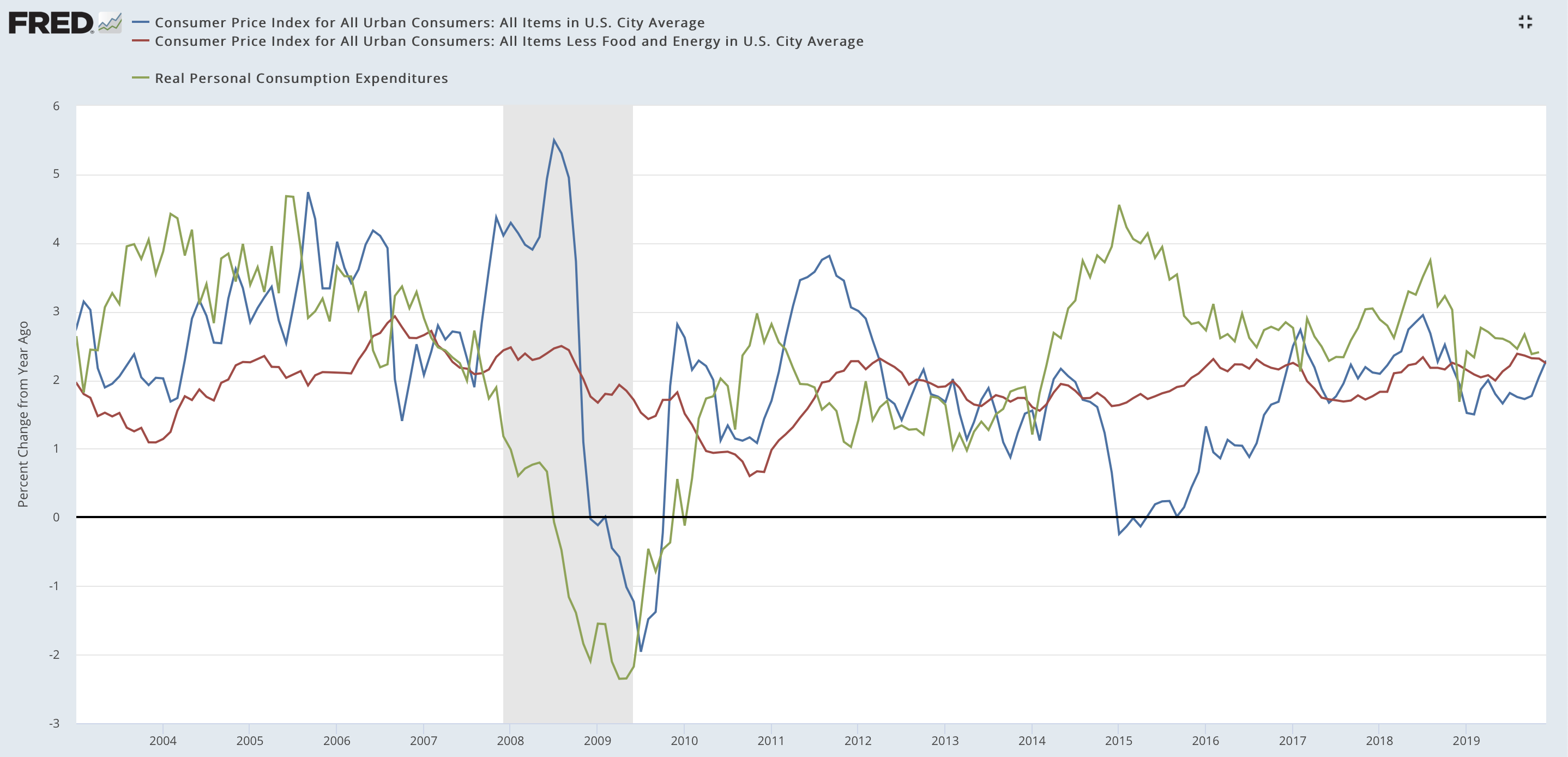

Which brings us to why core CPI is useless. For the past three years, there’s been very little daylight between core CPI and all-items CPI. But there have indeed been times when food or energy – usually energy – prices behaved in an unpredicted way. During the Great Recession, the broader measure swung from 5.2% to a deflationary -1.5% while the core rate stayed around 2%.

Gasoline and heating oil prices really do matter but, if your income is subject to a COLA, it’s probably indexed to core inflation. If oil goes back up to $140 per barrel, you won’t see an extra nickel, but you’ll still have to pay for it at the pump. If the price of beef goes up, well, we hope you like tofu.

Time Passages

While core CPI still gets the most headline coverage on CNBC and in the pages of the Wall Street Journal, it is increasingly ignored as a decision-making tool.

Social Security COLAs are based on an annual inflation calculation – CPI-W – which includes food and energy and is steeped in the spending habits of wage earners and clerical workers.

Similarly, the Labor Department’s CPI-E focuses on how the elderly – defined as those over age 62 or married to someone over 62 – spend their money. Most notably, it accounts for increased medical costs, which rise faster than any other category of personal expenses. You might wonder why Social Security uses CPI-W instead of CPI-E to calculate COLAs.

It’s because CPI-E doesn’t actually exist. It was an experimental series collected from 1982 to 2012. If it’s still being calculated, you won’t find it on a government website – not even as a discontinued database. When it was reviewed at the end of its run, the conclusion was that CPI-E was 0.2 percentage points higher than CPI-W. In other words, seniors’ purchasing power diminishes each year; we know it but choose to turn a blind eye.

When the Fed is gathering inflation data, it doesn’t even consider Labor Department statistics. Instead, it looks at personal consumption expenditure (PCE) as calculated by the Commerce Department as part of its gross domestic product (GDP) formula. Since its inception in 2003, PCE has told a very different tale than either core or non-core CPI.

Was January 2015 inflation 4.6% or 1.6% or was there actually a little deflation? We can’t tell. Credit: Federal Reserve Bank of St. Louis

What’s Going On

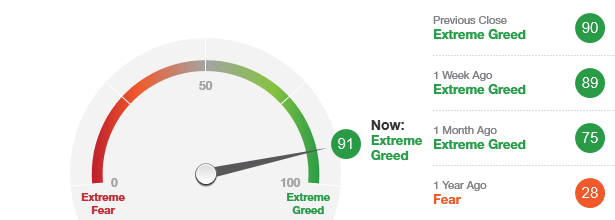

The good news is, however you measure inflation, the U.S. economy currently enjoys a healthy amount of it.

The bad news is, there’s a big difference between the aggregate economy and your unique situation. Inflation could still be eroding your particular income and investments. You might want to review how your pay or pension checks might be linked to one measure of inflation or another.

And, if you believe there’s a very real risk that high inflation can appear seemingly out of nowhere – that is, if you remember when double-knit plaid leisure suits were trendy – then you might want to ask a professional financial advisor about vehicles to insulate you from any potential erosion of the value of the dollar.

Oh, and maybe you should bring someone with you when you go clothes shopping.

(Note: The newsletter team congratulates those readers who noticed that all the above subheadings were taken from the titles of best-selling albums of the 1970s. While many believed the leitmotif was so far Off The Wall as to merit this note, the original author maintains that, if you didn’t get the references, you must have been living on The Dark Side of the Moon.)

Rex Moxley joined Smith Anglin in 2001. Since then, he's served as a Managing Partner and as a member of the firm's Investment Committee. He regularly meets with prospective clients, counsels existing clients, participates in investment portfolio analysis and develops materials for communicating with the firm's clientele and target markets. He holds a BBA in Finance and Marketing, a graduate degree in Law and numerous securities licenses and designations.

Rex Moxley joined Smith Anglin in 2001. Since then, he's served as a Managing Partner and as a member of the firm's Investment Committee. He regularly meets with prospective clients, counsels existing clients, participates in investment portfolio analysis and develops materials for communicating with the firm's clientele and target markets. He holds a BBA in Finance and Marketing, a graduate degree in Law and numerous securities licenses and designations.