Market Overview

This month's models have been posted.

New ways to make – or lose – a fortune on blockchain

Just when we thought we had our heads around cryptocurrency, the geniuses who cooked it up came out with some new twists. You don’t need to go anywhere near Bitcoin or Ethereum or Ripple or any other of these – old-fashioned? – tokens to speculate on the blockchain. There’s a whole host of other digital assets you can now make, or lose, a fortune on.

We’ll probably need to revisit this in a year or so, but here’s a look at a couple new asset classes that are popping right now: non-fungible tokens (NFTs) and metaverse real estate.

NFTs: long way in a short time

Cryptocurrencies are intended to render buyers and sellers anonymous. NFTs, though, are the exact opposite – an entire branch of the blockchain ecosystem devoted to making those parties widely known and the terms of their trades as transparent as possible.

An NFT is generally associated with a particular digital or physical asset and a license to use the asset. These can be traded on exchanges or sold outright. Ethereum.org offers these examples:

- A unique digital artwork

- A unique sneaker in a limited-run fashion line

- An in-game item

- An essay

- A digital collectible

- A domain name

- A ticket that gives you access to an event or a coupon

While the first NFT was minted in 2014, it wasn’t until 2017 that the market for them took off. NFTs were popularized, embarrassingly enough, by CryptoKitties, an online game that allows people with too much time on their hands to buy, collect and sell virtual cats. It bears mentioning that, in 2017, anything adjacent to blockchain was a private equity magnet, so CryptoKitties sopped up $12 million from some of the biggest players in Silicon Valley.

It wasn’t until 2021, though, that global daily sales of all NFTs exceeded – or even approached – $1 million, according to Nonfungible.com. And then the market erupted like Krakatoa. By August, that daily sales total approached $1.8 billion-with-a-B. It’s settled down since, but it’s not unusual for half a billion dollars to change hands over NFTs on a given day.

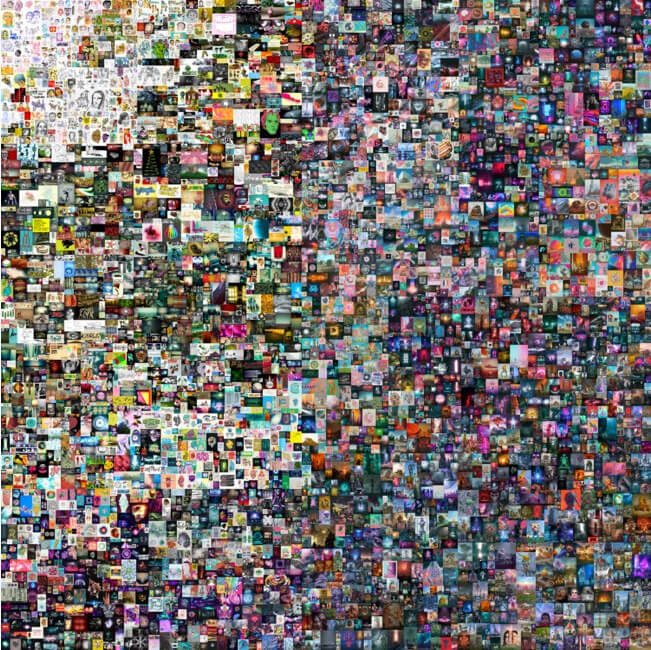

The new asset class was bound to catch fire anyway but Christie’s, the famous auction house, accelerated it. A digital artist known by the handle Beeple – but, considering he’s a grown man let’s just call him Mike Winkelmann – spent a dozen years creating one work per day, then combined them into an array he titled Everydays: The First 5000 Days. On March 11, 2021, Christie’s gavel came down and somebody bought Everydays – which, again, is a bunch of pixels with an electronic receipt – for $69.3 million. Not to be outdone, the anonymous designer who goes by Pak cashed in for $91.8 million with his NFT Merge, which was sold through blockchain-native auction house NiftyGateway. Works by Van Gogh and Monet didn’t sell for that much in 2021.

One of the NFTs which are worth more than a Van Gogh. Beeple’s $69 million opus, Everydays: The First 5000 Days. Credit: Christie’s

Nonfungible.com reports that, over the course of 2021, the average NFT price rose from $200 to $5,000, so there’s more to this than just the rarified world of visual art. Eminem is not the only musical act, nor is Quentin Tarantino the only film director, producing their works in NFT form.

You have to be pretty old to remember when sports trading cards came free with a pack of chewing gum – and even older to remember them coming free with a pack of cigarettes. Many of us, though, have bought boxes of Topps or Upper Deck cards at collectibles shops. If you left the factory plastic wrap on, grew up, forgot about these and rediscovered them during a cleaning binge, then maybe you were pleasantly surprised by how much somebody on eBay was willing to pay for them.

But even that’s going the way of tobacco-scented Honus Wagner cards. Led by the NBA, professional sports are moving their trading card business onto the blockchain.

NFTs can also be used as exchange mechanisms between in-game economies. They allow someone who plays two different video games — and is better at one than the other — to buy swag in the one they’re not as gifted at. Someone who has more credits in the video game Overwatch than they can spend can translate them into riot points in League of Legends, at which they stink but you wouldn’t know it by looking at all the stuff they bought with converted Overwatch currency.

Ultimately, though, anything can be turned into an NFT so long as it really is one of a kind: your presence at a concert, a trademark, a copyrighted work, a diamond, the deed to your house. In time, any proof of provenance might well be replaced by NFTs’ technological elegance. If you own the NFT, then that was clearly you in the front of the mezzanine at a Toby Keith concert, that you designed that start-up’s branding, that you wrote every word of that 300-page novel, that the diamond you’re wearing did not come from a conflict zone, that you don’t need a title search to prove that you own your home.

Metaverse real estate

On the blockchain, though, there’s no need for your home to actually exist. That’s because the metaverse – social media’s Next Big Thing – is being built on blockchain technology.

“The metaverse comprises multiple digital realms. Each is like a 3-D virtual city where avatars live, work and play,” according to the New York Times’s Square Feet column. “But real estate investing in the metaverse still is highly speculative, and no one knows for sure whether this boom is the next big thing or the next big bubble.”

Someday and perhaps someday soon, the metaverse will be an immersive virtual reality experience. Once you’ve got your haptic gear on, you can be transported to a make-believe world where all your friends are right next door.

With much hoopla, Facebook recently changed its name to Meta. Still, Mark Zuckerberg’s isn’t the first money into the metaverse and might not be the money that comes out ahead.

“Technologists believe the metaverse will grow into a fully functioning economy in a few short years and offer a synchronous digital experience that will be as integrated into our lives as email and social networking are today,” according to the Times. “Money in these digital worlds is cryptocurrency, as finance in the metaverse is powered by the blockchain. … Anyone entering a virtual world can buy or trade art, music and even homes as … NFTs.”

The exemplar of metaverses is a world called MANA, created by the Decentraland team, which has districts for gaming, shopping, fashion and the arts. Louis Vuitton and Gucci are among the brands which already offer NFTs for your metaverse avatar to wear. Prices for space in MANA – retail, office, residential – are rising. A parcel of land in its fashion district recently sold for $2.5 million. There are even REITs trading on crypto exchanges.

IRS doesn’t take crypto

You’ll notice one thing about our discussion of NFTs and of metaversal real estate: They’re both denominated in U.S. dollars. Yes, you might bid on an NFT using Ethereum cryptocurrency, and you might spend Polygon cryptocurrency to support your Decentraland lifestyle. Before you do, though, you have to exchange dollars for them.

And that’s fine if what you’re doing is buying keepsakes or showing off your style as a conspicuous consumer. If you’re looking to eventually sell something you bought on the blockchain, though, you should talk with a trusted financial advisor who knows both money and technology.