Market Overview

Optional features

Equities boomed last year. A positive year was expected by many, although the extent of the upside came as a surprise to many market followers. In addition to the surging S&P 500 performance, it was a record year for exchange-traded funds, meme stocks, SPACs, IPOs and a whole bunch of other formerly obscure instruments.

They say this can’t last forever, but they have said things like that every year for the past decade. It is still true and, even if it weren’t there’d be no way of knowing if 2022 will see a gain of 3% or of 30%.

If you want greater control over your returns and you’re not one to just park your entire nest egg in an index fund, you have the option of investing in, well, options.

(Before we proceed, we remind you that this article is for educational purposes only and we’re not recommending options trading for all readers. Consult your financial advisor before starting options trading.)

Contracts expand, but does knowledge?

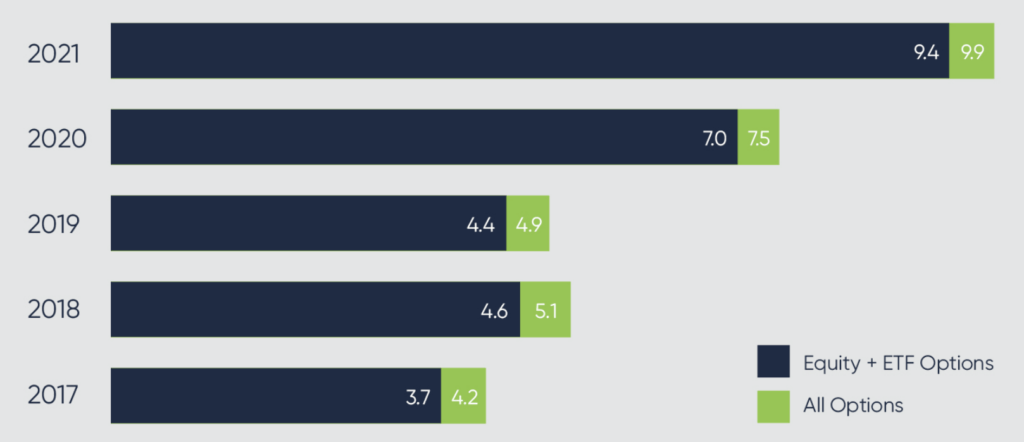

A lot of people dove into options trading during the pandemic. According to the Options Clearing Corp., investors traded a record 7.5 billion options contracts in 2020 then blew past that in 2021, when 9.9 billion contracts changed hands.

Option contract volume in billions. Credit: OCC

We’re not convinced that everyone who traded an option, though, knows what one is. Let’s start there. An option is a contract giving the investor the right – but not the obligation – to buy or sell a specific security at a particular “strike” price during a given period, ranging from days to years. When that time ends, the option expires and loses all value. As expiration dates approach, options lose value.

There are two kinds of options:

- Calls give the buyer the right to buya specified number of shares – usually 100 – of a stock or ETF at the strike price any time before the contract expires.

- Puts give the buyer the right to sella specified number of shares at the strike price any time before the contract expires.

Options trading is complex and can be risky.

“[I]nvestors can lose as little as a small prepaid amount of the premium when a trade moves against them and seems set to expire out of the money, or they can experience as unlimited losses — their initial investment, plus infinitely more — depending on the strategy used,” Elizabeth Gravier writes for NBC Select.

Gravier points newbies toward the Securities and Exchange Commission’s options terminology explainer and online options-trading courses offered by Udemy and Skillshare.

Tools, not magic bullets

“Like all investment choices you make, you should have a clear idea of what you hope to accomplish before trading options,” Gravier cautions.

Essentially, there are two things you can do with options: maximize income from trading or minimizing the downside of those decisions you made that the market moved against.

“In terms of advantages, options trading can offer flexibility as well as liquidity. Compared to other investment options, you may be able to invest with smaller amounts of capital,” according to Ally Invest senior options analyst Brian Overby. “Options can be used to create downside risk protection and diversify your portfolio. And a savvy options trader could generate substantial returns.”

There’s a certain amount of 3D chess involved in even the most basic options trading. Experienced traders generally don’t just buy or sell an option in isolation; it’s usually part of a bigger strategy with a precise goal. Overby lists three of these strategies:

- A covered call has two parts: You purchase an underlying asset. Then you sell call options for the same asset. So long as the stock doesn’t move above the strike price, you can realize profits by selling call options for the assets you own.

- A married put involves purchasing an asset and then purchasing put options for the same number of shares. This approach gives you a measure of downside protection by allowing you the right to sell at the strike price.

- A long straddle involves buying a call and put option for the same asset with the same strike price and expiration date at the same time. This approach may be used when an investor is unsure which way prices for the underlying asset are likely to move.

Failure actually is an option

Before taking on the risk of options trading, you might want to calculate the maximum gain, maximum loss and breakeven points of your strategy. Of course, you need to benchmark those against your personal risk tolerance before you can determine if dabbling in options are a good idea.

While there are options profit calculators on the Web, you might be more confident in the quantitative rigor of your trusted financial advisor. This professional might be able to provide feedback into what your true risk tolerance is. In addition, the exercise might be helpful in determining which broker offers you the precise tradeoff of low fees, research, tools and human touch that you need to comfortably trade options.