Market Overview

This month's models have been posted. There are NO CHANGES in the models. The rest of the newsletter will be posted near the middle of the month. Happy New Year!

Welcome to the soft landing. Why does it feel so hard?

They say, “Any landing you can walk away from is a good landing.” Except at New York’s LaGuardia Airport. There they say, “Any landing you can swim way from …”

And yet neither seems to be the standard for an economic touchdown. An overheated economy resulted in the highest inflation rate in a generation until the Federal Reserve stepped in – too late according to many economists, unnecessarily according to libertarians. The higher interest rates induced by the Fed led to less economic activity, taming inflation at least somewhat. Treasury Secretary Janet Yellen is already taking credit for a “soft landing”.

Even so, wide swaths of the American populace don’t see it. They don’t believe the economy is improving. Either that, or they believe it’s improving for somebody else but not for them. Whether or not their opinion is accurate statistically, it’s certainly valid politically. Facts matter, but so do people and their lived experience.

Alexander Hamilton – who created Yellen’s job – observed in 1802, “Men are rather reasoning than reasonable animals”. By this he meant that, whatever the big picture might show, individuals are going to start their analysis of it from their own perspective.

It’s as if he were watching us through a crystal ball.

The macro facts

Here’s what’s going right:

- Inflation, which peaked above 9%, is now around 3% -- much closer to the Fed’s 2% prescription for an optimal economy.

- Unemployment hit a 50-year low before rising slightly due to an increase in labor participation; our economy has grown jobs for 30 straight months, including 800,000 new manufacturing jobs.

- Gross domestic product is growing at a 2% annual rate – a healthy clip for a mature economy.

- The Fed funds overnight interest rate, which hit 5%, has settled down to around 4%.

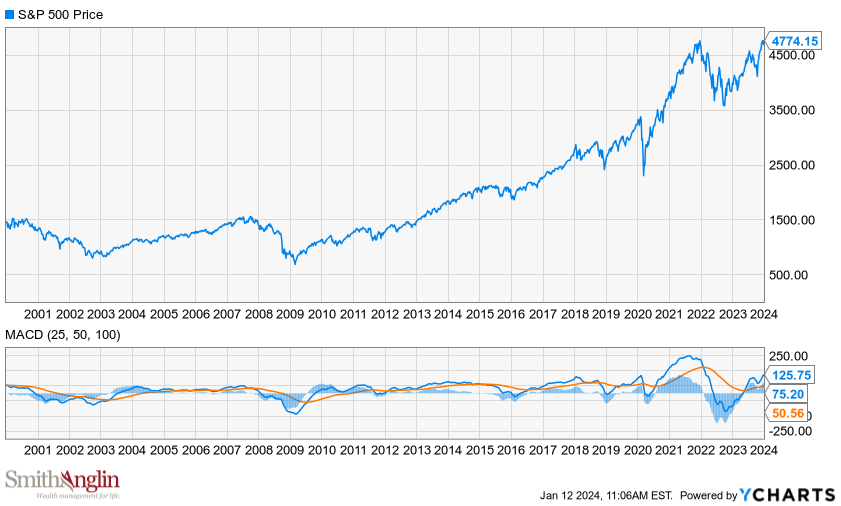

- The Dow Jones Industrial Average rose 13%, the S&P 500 24% and the Nasdaq 43% in 2023.

There is one piece of potentially bad news that ought to be mentioned with the good: The yield curve is inverted and has been for almost three months. That means you can get a higher interest rate for a two-year investment than a 10-year one, so why would anyone make a 10-year one? Yield curve inversions often presage recessions.

Still, we use the word “potentially” with great deliberation. What an inverted yield curve really indicates is that investors expect interest rates to drop going forward. That might mean the economy is expected to contract, so the Fed is going to be forced to lower interest rates to resuscitate it. Or – and this seems to fit the facts today – it might mean anybody with an E-trade account already knows that interest rates are as high as they’re likely to go for now and can only move downward from here.

How far is an open question. We’re probably not going back to the near-zero rates we saw during the pandemic or the 2008-09 recession. And with a bloated national debt that no administration in this millennium has seriously addressed, we might need to get accustomed to higher rates.

The micro experience

So, despite the inevitable clouds on the horizon, the economic outlook is good. That doesn’t square, though, with what a lot of average Americans experience today.

“My income has stayed the same,” Steve Shapiro, an audio engineer from Pittsburgh, told the Associated Press. “The economy is good on paper, but I’m not doing great.”

The AP highlighted his comment to illustrate that three-quarters of the Americans it surveyed believe economic conditions are poor. The AP poll shows that household expenses are going up, and people generally don’t trust either political party to tamp down inflation. Meantime, they report that their debt is rising, their savings are dwindling and their incomes are stagnant. They don’t believe they can afford an unexpected hospital bill, no less a retirement. One in three have foregone a major purchase due to high interest rates.

The poll doesn’t discuss which particular household expenses are up, but we can take an educated guess. Blood pressure tends to rise with gas prices, and they both come down slowly. At the moment, gas prices are coming down faster.

Food prices can also be volatile and had been in recent times. Ultimately, though, the cost of groceries hasn’t been rising any faster than overall inflation over the past year. Still, it’s not going down. The price increases got passed through and they’re stuck at an elevated level; that’s almost as bad optically as if the prices had kept rising. Much the same can be said for new vehicles.

“Most Americans are not just looking for disinflation,” that is, a slowdown in price increases, according to Fed official Lisa Cook. “They’re looking for deflation. They want these prices to be back where they were before the pandemic. ... I hear that from my family.”

What’s driving core inflation is housing costs. Rents are up 6.5% over the past 12 months, and it’s next to impossible to buy a home because of mortgage rates. Not only are new prospective homebuyers limited by the expense of borrowing, nobody sitting on a 3.75% 30-year fixed rate wants to give it up by selling.

Add it all up, and real wages eroded in 2021 and 2022. They’re bouncing back now, the Economist reports, but still a couple ticks below where they were pre-pandemic.

We haven’t even taken the educational wage gap into account. In some states, those with a bachelor’s degree make more than twice on average what a high school diploma holder earns. It’s clear who the winners and losers are in this seemingly robust economy, so the resentment is understandable.

Founding fodder

Secretary Hamilton had the right of it, and 222 years of economic and political analysis backs him up. Turns out, there’s no such thing as good economic news. If there’s a good economy, it’s not news.

Statistics around personal income are coincident indicators, and those around inflation are lagging indicators. They tell us how things are or how things recently were. While they have no predictive value, they’re very accurate descriptors of what’s going on across kitchen tables today. And the disconnect between those and what we call leading indicators is the difference between how wage earners see the economy and how economists do.

But let’s look at one last more coincident indicator. We don’t have the Christmas season’s final numbers yet, but we do know that retail sales were up in November compared to the year-earlier period; this suggests that, whatever people are saying or feeling, they’re acting as if they’re optimistic about the future. If the economy keeps improving, it will become questionable that the Democrats-are-bad-for-business argument will still be as powerful in November – when it counts – as it is in January.

The effectiveness of that message might well determine who gets sworn in a year from now, and that binary choice is bound to affect your financial planning. While nobody can predict what’s going to happen between now and then politically, you might want to talk with a trusted financial professional to have a plan to address it.