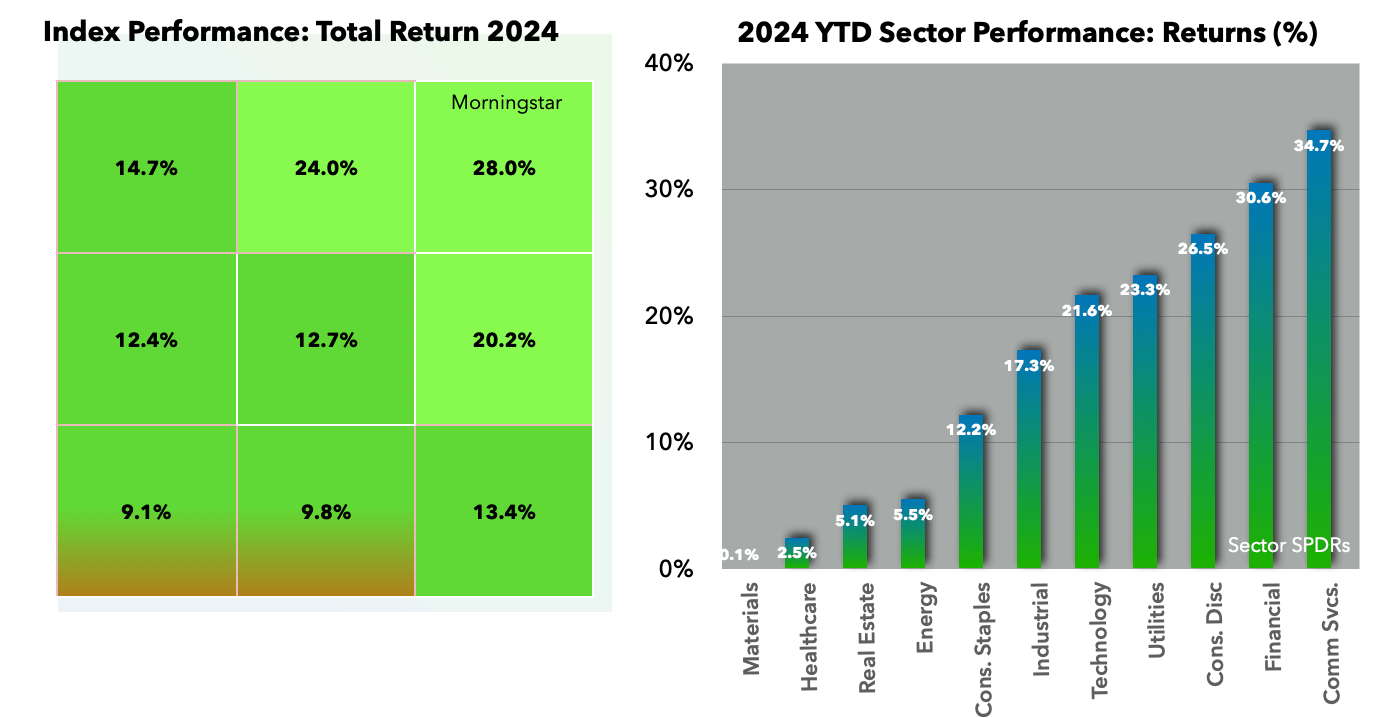

In summary, 2024 was marked by significant growth in equity markets driven by strong corporate profits, easing monetary policy, and artificial intelligence investment. Staying informed and adaptable remains crucial as we transition into 2025.

Some of the key market risks being considered by market pros are:

Inflation: “throughout history inflationary cycles tend to have multiple peaks” -Marci McGregor, BofA Merrill Lynch

Supply-side hiccups: “much of the US economic momentum is due to strength on the supply-side, especially labor. With tighter (immigration) policy, that dynamic can get disrupted” - Josh Hirt, Vanguard

Rise in valuations: “The thing to watch out for in the new year is that [valuations] are priced for perfection, any deviation from perfection is going to result in some pretty heavy negative marks.”- Matt Rowe, Nomura Capital Management. “

Washington policy uncertainty: “How [Trump’s] policies are executed will be very important for near-term growth” - Seth Meyer, Janus Henderson Investors.

As we look ahead, sustaining the growth achieved in 2024 will rely on economic data and earnings performance beyond mere Fed policy shifts. It's crucial to closely monitor these indicators to gauge the market's resilience. We encourage investors to remain informed, maintain an appropriate risk profile, and closely observe market trends while being mindful of potential risks amidst the prevailing optimism. Our commitment lies in guiding investors through potential challenges, supporting a long-term investment approach, and remaining attentive to market developments.