Market Overview

This month's models have been posted. The rest of the newsletter will be posted by middle of the month. There are CHANGES in ALL THE MODELS (highlighted in yellow).

Breaking up big tech

Hard to believe, but it’s been almost 40 years since a major antitrust action succeeded in U.S. courts.

American Telephone & Telegraph had been considered a “natural” monopoly. A straight line could be drawn from inventor Alexander Graham Bell’s American Bell Telephone Co. of the 1880s to the behemoth AT&T had become by the mid-20th century; the legal theory was that no monopoly can exist in a space in which, prior to one company’s emergence, no market existed.

AT&T started out as an array of local phone networks then built out its long-distance lines, a process which took decades. In that time, quite a number of local competitors emerged but, with the tacit blessing of regulators, Ma Bell either bought them up or otherwise coopted them. Washington also turned a blind eye to AT&T’s buying up radio patents which made the company’s long-distance service impossible to match technologically, according to World Heritage Encyclopedia.

Along the way, AT&T developed a reputation for, well, being a bunch of jerks. This was satirized throughout the late 1960s by Lily Tomlin’s Ernestine the Operator character on Rowan & Martin’s Laugh-In, whom she reprised in 1976 for the classic Saturday Night Live sketch, “We Don’t Care, We Don’t Have To.”

Six years later a federal judge wasn’t amused, and United States v. AT&T mandated the breakup of the Bell System into eight regional “baby Bells” while Western Electric was also spun off. AT&T continued as a long-distance carrier and held onto the Bell Labs R&D powerhouse.

It’s now been virtually four decades since AT&T was broken up, and almost a hundred since Standard Oil was. The list isn’t a whole lot longer than that. So why is now the time to see antitrust action succeed against such contemporary monopolists as Facebook or Amazon?

Because both major political parties, each for its own reasons, desire it.

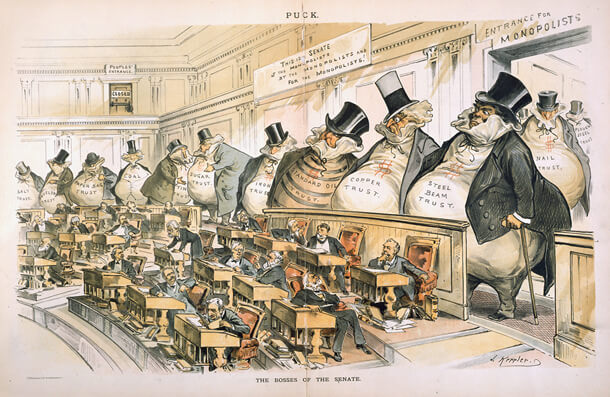

This Joseph Keppler cartoon, which appeared in Puck in 1889, is captioned “The Bosses of the Senate”. With current activity on Capitol Hill, we might soon find out who’s boss.

Lina’s laws

There are two major pieces of antitrust legislation on the books in the U.S.:

- the Sherman Act of 1890, which prohibits competitors from colluding to create cartels and also prohibits individual companies from taking actions to become monopolies; and

- the Clayton Act of 1914, which specifies what constitutes anti-competitive practices, calling out price discrimination, locking buyers into further purchases, mergers that form monopolies, and individuals who serve on competitors’ corporate boards.

Along with the Clayton Act, President Woodrow Wilson launched the Federal Trade Commission and granted it regulatory authority over antitrust matters.

While the FTC has been able to claim many small-ball prosecutorial successes as well as a number of mergers-that-weren’t due to the threat of a suit, the commission has hit very few home runs. (Microsoft was a big swing-and-a-miss.) A lot of that has to do with changing times. It’s hard for acts passed during what is now called the Progressive Era to have much air cover since the inflection point of the 1980 Reagan Revolution.

“Size can become a menace--both industrial and social,” Justice William O. Douglas wrote. "Industrial power should be decentralized. It should be scattered into many hands so that the fortunes of the people will not be dependent on the whim or caprice, the political prejudices, the emotional stability of a few self-appointed men.”

But, as we said before, personnel is policy and President Joe Biden is head of HR. It surprised few that he nominated Lina M. Khan to be his FTC chair. After all, her first published article was a hit job against Amazon and its monopolistic tendencies. At 32 – still in law school when Donald Trump was sworn in as president – she might be perceived as lacking in gravitas, and yet the Senate confirmed her 69-28. All Democrats present at the roll call voted to confirm Khan, but so did 21 senators on the right side of the aisle.

FTC Chair Lina Khan, the new face of trust-busting.

Both sides against the meddle

Liberals and conservatives each have their own reasons for breaking up Big Tech, and they might both surprise you.

Most people think that the reason why monopolies are considered bad is that, when trade is restrained, consumer prices go up. That was the case with AT&T; think about how much you paid for long distance in 1982 and how much you (don’t) pay now. And while you’re probably paying more for your phone, you’re getting more from it and you also get the benefit of the trade-in value.

But Amazon has actually made life more affordable and convenient for many. And pretty much anything Facebook offers to the public is offered at no charge. But there we get into the guiding principle of social media: If the product is free, then you’re the product. (That’s a paraphrase of something artist Richard Serra said, prophetically, in 1973. He was talking about broadcast television at the time.)

In her takedown of Amazon, Khan pointed out that consumers can be harmed by monopolies even if short-term prices for goods goes down. That’s because the companies gain two other levers: They can increasingly set the pace and direction of innovation to suit their own purposes rather than the public’s, and they become dominant employers in the communities in which they operate, so they can keep suppress wage growth instead of product prices in order to increase their earnings.

Because growth rate is the metric of the new economy rather than profit, lowballing can be seen as more predatory than price gauging, Khan argues. She further posits that this growth helps the tech giants acquire and control data and infrastructure, which can then lead to restraint of trade.

While any legal opinion can be argued, the fact remains that one-third of cloud services run over Amazon Web Services so, even if a company has nothing to do with retail – or even if it did and is in direct competition with the Amazon sales platform – it quite likely is still paying a monthly subscription to Jeff Bezos’s empire for the privilege of using computing power, storage and software.

So Khan favors a return to Justice Douglas’s thinking that monopoly power is inherently in opposition to the public interest.

Conservatives see a problem with Big Tech, but it’s a different problem. Still, the remedy – break ‘em up – is the same.

Acts of Congress, Acts of the Executive

Many conservatives are concerned that social media companies like Facebook and search engines like Google are filtering and moderating against right-wing positions. And this might be true. The question is whether they are maliciously suppressing free speech or if they are simply tamping down sources of misinformation or voices calling for violence. And, if the latter, are they being even-handed about quashing lies or sedition from the left?

Senate Democrats, meantime, are lining up behind the Competition and Antitrust Law Enforcement Reform Act to bring antitrust into the 21st century.

The Executive branch has also been active on this front. Under Khan’s watch, the FTC has already picked a fight with Broadcom, charging that the semiconductor supplier requires its customers to source their components exclusively with it. It also ordered 7-Eleven to divest almost 300 stores following its acquisition of Marathon Petroleum’s Speedway subsidiary. The commission has also taken action against apps that collect personal information from children and health data from women trying to get pregnant.

Biden for his part is staffing up his antitrust team inside the White House. He recently named Tim Wu – the Columbia Law professor who championed net neutrality as a tonic for anticompetitive behavior among internet service providers – to his National Economics Council. At deadline, the president had just announced an executive order “establish[ing] a whole-of-government effort to promote competition in the American economy,” according to a White House press release. “The Order includes 72 initiatives by more than a dozen federal agencies to promptly tackle some of the most pressing competition problems across our economy.” While not all of it has to do with antitrust issues per se, it directs the FTC and Justice Department to open cases against mergers that previous administrations declined to challenge, and focuses enforcement on the tech and healthcare sectors.

All this action – whether it comes from Congress, the executive branch or both – would have at least a short-term negative impact on M&A. It could even cause the breakup of some mega-cap companies. But that’s not necessarily bad news for investors. When conglomerates are decomposed into their parts their stocks have to split, and value is often unlocked. Also, the wind would be at the backs of many large – but not super-large – companies as they take advantage of the situation. There are a lot of ways to play the decomposition of the tech giants. Perhaps you should talk to a trusted financial advisor as to which strategy would work best for you.