Market Overview

Where you can retire with $1 million and actually live like a millionaire

We’ve been big fans of Visual Capitalist for some time, big enough to risk being a little too heavily reliant on the site. We couldn’t resist showing you one of their infographics last month, and we feel the same way today:

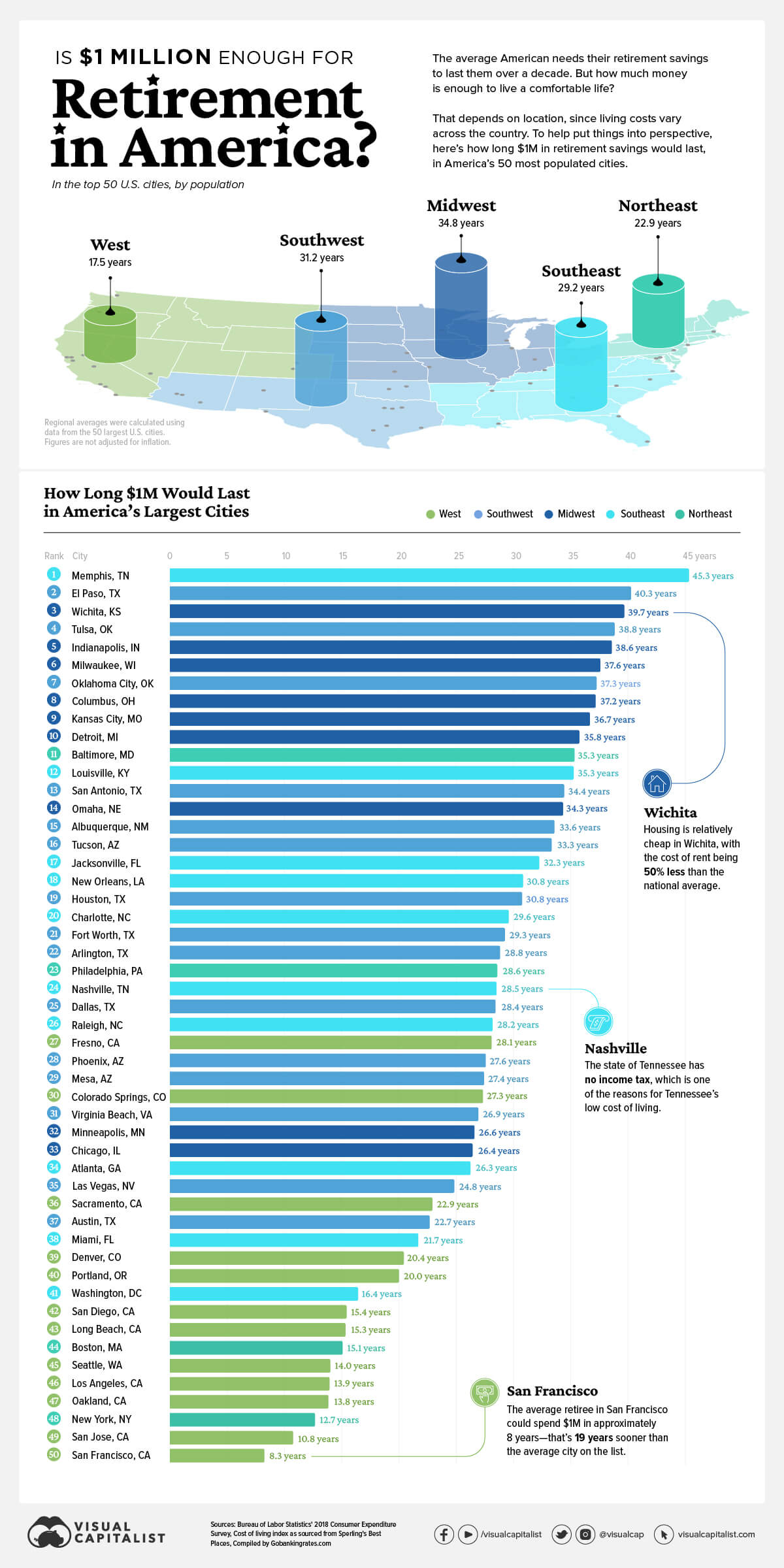

How long $1 million would last you in America’s largest cities. Credit: Visual Capitalist]

According to Visual Capitalist’s analysis, $1 million would fund a retirement that lasts almost 35 years in the Midwest, compared with less than 18 years in the West. Let’s bear in mind that we’re talking about urban areas – clearly, you could live cheaper in the shrublands of western New Mexico than on Wacker Drive in Chicago. So let’s drill down and compare the 50 largest American cities.

The highs and lows

The clear winner is Memphis, Tenn., where $1 million buys you more than 45 years of retirement. In other words, it’ll take you longer to spend your money than it did to acquire it. Cross-state rival Nashville also ranks high on the list.

“The state of Tennessee has no income tax, which is one of the reasons for Tennessee’s low cost of living,” Visual Capitalist notes.

The Volunteer State, though, is not the only state without an income tax. In fact, it didn’t abolish it until 2021. It only recently joined Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

It’s understandable that Alaska isn’t on this list of retirement havens. First, the state has the sixth-highest cost of living in the country because almost everything needs to be shipped in from the Lower 48. Second, there are no cities there that rank among America’s 50 largest; Anchorage is 76th. Sioux Falls, the population center of South Dakota, ranks 137th. Cheyenne, Wyo., isn’t even in top 200.

Florida, despite its low-tax reputation, is actually in line with national averages when it comes to consumer prices, so perhaps we shouldn’t be too surprised that its biggest city, Miami, ranks 13th from the bottom while second-largest city Jacksonville ranks 17th from the top. Nevada’s sole entry, Las Vegas, is at a disadvantage; its cost of living ranks between those of cosmopolitan Atlanta and of Sacramento, the capital of America’s highest-taxed state.

Texas cities fare better. El Paso ranks right up there with Memphis in terms of how long retirement savings will last you, and San Antonio isn’t far behind. Even the big cities – Houston as well as the tangle of Dallas, Fort Worth and Arlington – are more affordable than most large U.S. cities. Only in Austin, that stretch of the Silicon Valley which was magically transported into the middle of the Texas Hill Country, are you more likely to outlive your nest egg.

And while Washington State has no income tax, Seattle is still a very expensive place to live – comparable to Los Angeles. And even LA is cheap compared with San Francisco, where $1 million won’t last you much more than eight years.

Those cities on the West Coast from Seattle down to San Diego are places you go to make money, not live off it. Same can be said for the East Coast from Boston down to Virginia Beach. Once affordable places such as Denver, Colo., and Portland, Ore., can no longer be said to be welcoming to those on a fixed income.

More to life than money

Even if money were the only important thing, picking a retirement location would be no simple exercise. In addition to those 0% income tax states, Hawaii, Illinois, Mississippi and Pennsylvania have no tax on Social Security, according to The Balance. New Hampshire only taxes investment earnings. And Ohio, Oregon and Utah all have tax credits in place to entice retirees.

But this doesn’t tell you anything about property taxes, sales taxes, excise taxes, usage fees and other ways states have available to claw some of that money back. And of course, every municipality has its own tax formula; even if there’s no state income tax, there could be one imposed by the city.

This entire discussion is predicated on the idea that you’re moving somewhere else to retire. But why? If you’ve paid off your mortgage, it might not make financial sense to pick up stakes.

The Balance lists other determinants for retirement destinations: amenities for seniors, economic trends, crime rates, access to health care and, of course, the weather.

Ultimately, the decision is up to you. Your financial advisor’s office might not be able to give you guidance as to where the best hospitals or safest neighborhoods are, but it’s the best place to start when considering the bang-for-your-buck elements.