Market Overview

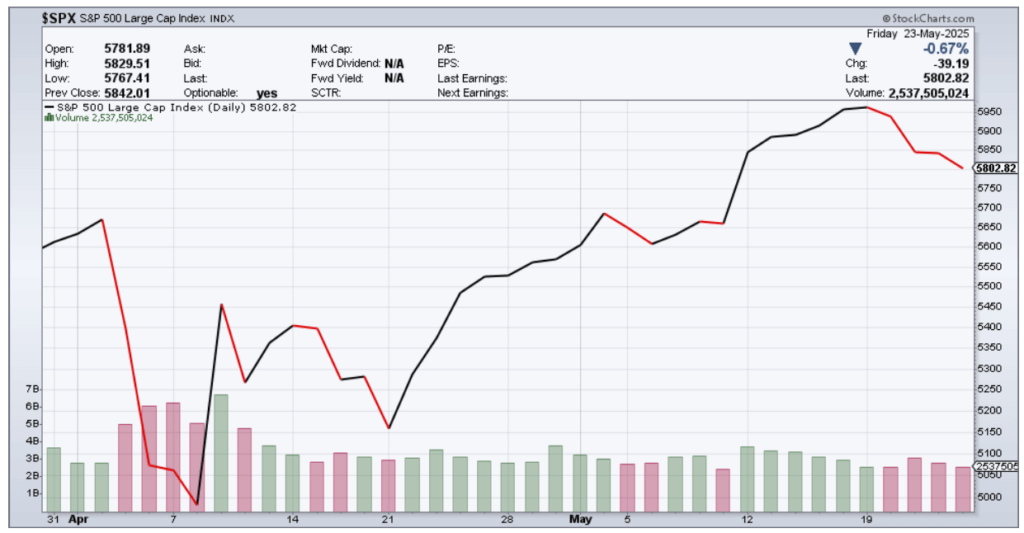

Since the last newsletter, temporary easing of trade tensions, AI-driven mega-cap outperformance, and better than expected earnings resulted in a broad-based rally that pushed the S&P up 5.0%, DJII +3.7% and the NASDAQ Composite up 7.8%. Model portfolios remain well balanced, however there are changes to most portfolios.

U.S. Markets Rebound on Earnings & Easing Trade Fears

U.S. equities rallied in May, with the S&P 500 gaining approximately 5.0% and approaching record levels as investors looked past geopolitical noise and focused on strong corporate earnings and a brief period of calmer bond market volatility. The Nasdaq-100 led the charge, lifted by better-than-expected results from mega-caps like Microsoft, and Alphabet, and continued momentum from Artificial Intelligence. Market strength was concentrated in growth sectors, particularly those perceived as less exposed to rising interest rates or global trade disruptions.

Tariff Tensions Ease — But Risks Remain

Markets dipped late in the month after President Trump proposed a 50% tariff on all EU imports, citing trade imbalances and frustrations with the progress on bilateral agreements. At the same time, President Trump called for Apple to relocate iPhone production to the U.S. Given that the EU is America’s largest import partner, this move threatens roughly $600 billion in potential annual trade, triggering immediate market concern.

A Likely Negotiating Tactic?

The 50% EU tariff proposal may be just a tactical move ahead of US-EU trade talks. This playbook mirrors the recent US-China tariff standoff, where President Trump threatened tariffs as high as 145% on Chinese imports, only to walk them back to 30% on May 12th (China reciprocated by lowering its tariffs on American goods from 125% to 10%). The current expectation is a similarly scaled-back version with lower sector-specific tariffs (e.g., autos, semiconductors, and pharmaceuticals) than an across-the-board hike. That said, the risk of EU retaliation remains, specifically targeting US tech and financial services, making trade policy a key variable as we head into the summer months.

What We’re Watching

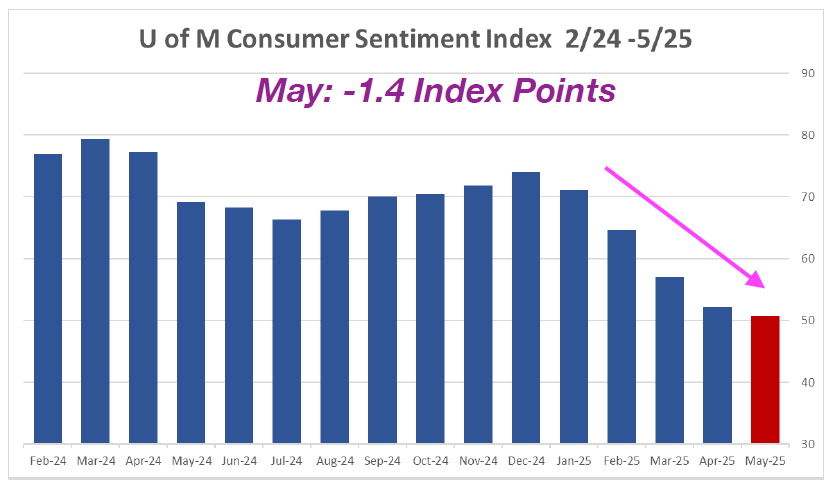

Index of Consumer Sentiment

US Consumer Sentiment, as measured by the University of Michigan Index, was slightly lower, inching down another 2.6% after 4 months of steep declines. Tariffs were

mentioned by over 3/4 of survey respondents, as uncertainty over trade policy dominates consumer thinking about the economy. The survey which was completed on 5/13 did not take into account the impact of the announced “pause” on some China tariffs. Year ahead inflation expectations jumped to 7.3%, and was recoded across the political spectrum.

Index and Sector Analysis

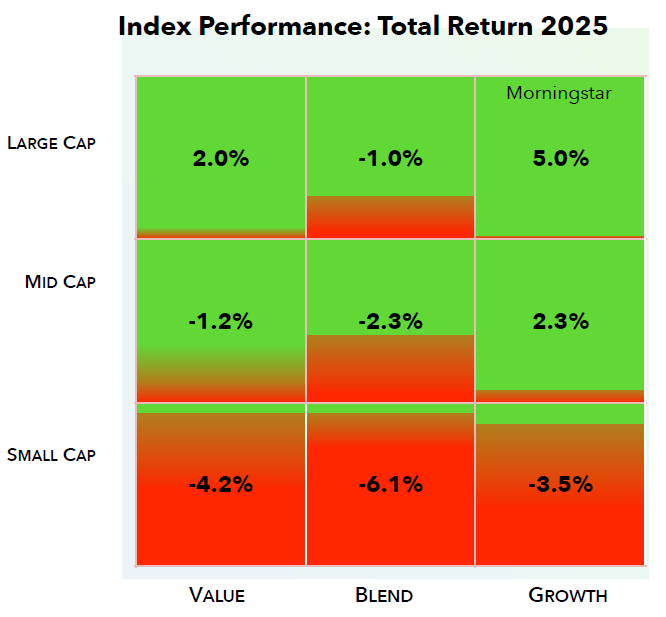

Indices: All index quadrants rose since the last newsletter, however growth quadrants were up materially more than value. On average, growth quadrants rose by about 6.5% from tech and industrials demand stemming from the US-China tariff “truce” announced on May 8. Value quadrants, while still in the black, only rose a paltry 1.9%, mainly from strong investor sentiment toward growth stocks, which reduces demand for value. The gains were rather evenly felt between large-, mid- and small-cap companies.

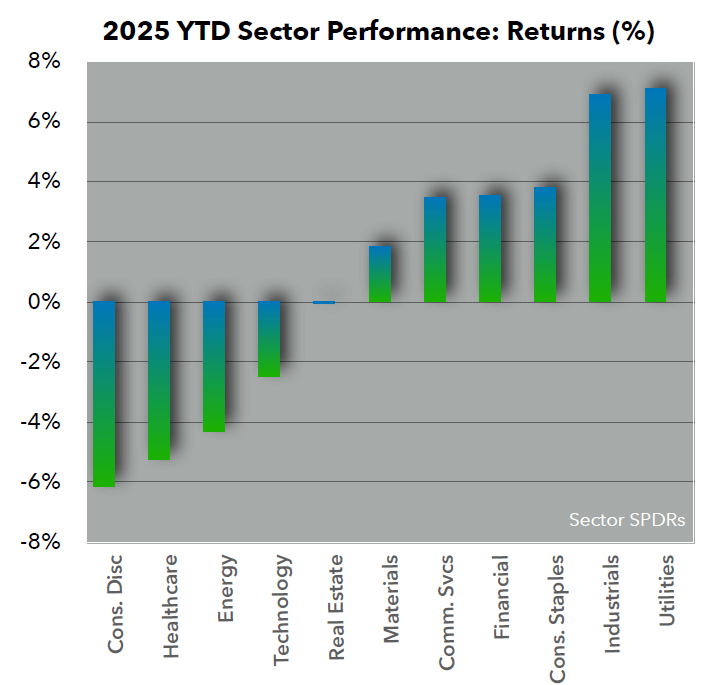

Sectors: With the S&P 500 index gaining 5.0% since the last newsletter, nine of the eleven S&P Sectors rose. The leaders were Industrials (+8.8%, on easing US-China trade tensions from the US -China tariff truce), Technology (+7.9%, on strong earnings from major tech firms such as Meta and Microsoft as well as the US-China tariff truce), and Communications Services (+6%). The sector most in the red was Healthcare (-5.6%) from reports of UnitedHealth Group’s being investigated for Medicare fraud, departure of its CEO and its decision to drop profit outlook, coupled with disruptions from regulatory uncertainty.

Fixed Income Market Update

Treasury yields rose sharply in May, with the 2-year moving to 4.00% and the 10-year climbing to 4.52%, as investors responded to a combination of inflation concerns, Fed messaging, fiscal risks, and global market pressures:

- Sticky Inflation coupled with US Growth: April CPI and PCE data came in hotter than expected, particularly in services, keeping core inflation well above the Fed’s 2.0% target.

- Fed Pushback: Several Fed officials, including Chairman Powell, signaled that rate cuts are unlikely in the near term without clearer evidence of inflation’s declining. Strong US consumer spending and economic activity similarly decreased the urgency for the Fed’s easing.

- Tariff Uncertainty: The proposed 50% tariffs on EU imports temporarily spooked markets, raising fears of added inflation and pressuring bonds. Investor demand at a treasury auction after the EU tariff announcement was remarkably low, also putting upward pressure on rates.

- Deficit Concerns: The House-passed tax bill extending 2017 tax cuts sharpened fears of persistent structural deficits, pushing long-term yields higher as markets priced in increased debt issuance.

- Global Bond Sell-Off: A sharp rise in ultra-long Japanese Government Bond (JGB) yields contributed to a global bond sell-off, adding upward pressure to U.S. rates as investors repriced risk across markets.

Given recent underperformance in the long end of the curve, USPFA’s model portfolios are gradually extending short-term Treasury exposure into longer-dated bonds, presenting a compelling opportunity to lock in higher yields across most moderate and conservative portfolios.

Corporate Earnings

One question asked is - with all of the uncertainty surrounding the tariffs and international trade, how may public companies have withdrawn or radically changed their outlook for the year? So far, of 478 companies that reported Q1 earnings by May 22, 259 of them (54%) had included EPS guidance for the current year. Of these 259 companies, only 8 (3%) stated that they were withdrawing or not updating previous EPS guidance for FY 2025. Six of these eight companies cited “uncertainty” associated directly or indirectly due to tariffs as the reason for withdrawing EPS guidance. This is much lower than the Q1 2020 earnings season that was impacted by the COVID lockdowns, in which 185 S&P 500 companies withdrew or did not update prior annual EPS guidance. This gives the impression that in general, firm management remains with a “wait and see” attitude, not radically altering projections either upwards or downwards, so far.

Toll Brothers (TOL), the nation’s largest luxury homebuilder, reported Q2 record sales and profits, as demand for high-end housing continues to exceed the current supply. Sales increased 2% over the same period in 2024 with the number of housing units increasing 9.7%.

Target (TGT) was downgraded to neutral by Bank of America analysts in conjunction with Q1 results that showed sluggish retail sales, that led to a Gross Profit margin and EPS miss.

Target’s miss did not extend to all of retail, as Urban Outfitters’ Q1 results (URBN) beat analyst estimates for both top-line and bottom line and leading to a 22% increase in the stock price, based on strength at all of its brands including Anthropology, Free People and Urban Outfitters.