Market Overview

This month's charts are now posted. There are CHANGES in ALL the models (highlighted in yellow).

Keep calm …?

It’s hard to stay calm when headlines like “Russia invades Ukraine!” appear everywhere you look.

And matters are made worse when you’re reminded that the reckless aggressor in the conflict is a nuclear power which is just a short series of missteps away from leading to World War 3.

Honestly, if global nuclear war is at hand, then the volatility of your investment portfolio probably won’t be the most concerning thing in your life.

The truth is no one knows for sure how Russia’s invasion of Ukraine will ultimately work out. But, if the past is any indication of the future, then there can be just as much danger in overreacting to geo-political events as to sitting complacently by and doing nothing. Panicking is almost always a mistake. The best thing an investor can do is to have a plan in place, and then execute on that plan with discipline.

We couldn’t have said it better ourselves.

The market has seen it all

Perspective is more constructive than panic, and a great way to gain perspective is to consider what has happened in the past when events like Russia’s recent invasion of Ukraine transpired. It’s not unprecedented for a totalitarian dictator with a history of invading smaller territories to do it again, even under the flimsiest of pretense. Usually, the victim is an outmatched neighboring country. Consider, for example, Germany’s invasion of Poland. When German troops and tanks rolled over Poland’s western border on September 1, 1939, that event kicked off what many consider the beginning of World War 2. Technically, the war started July 7, 1937, when Japanese forces confronted Chinese defenders at the Marco Polo Bridge near Beijing, but that’s another story.

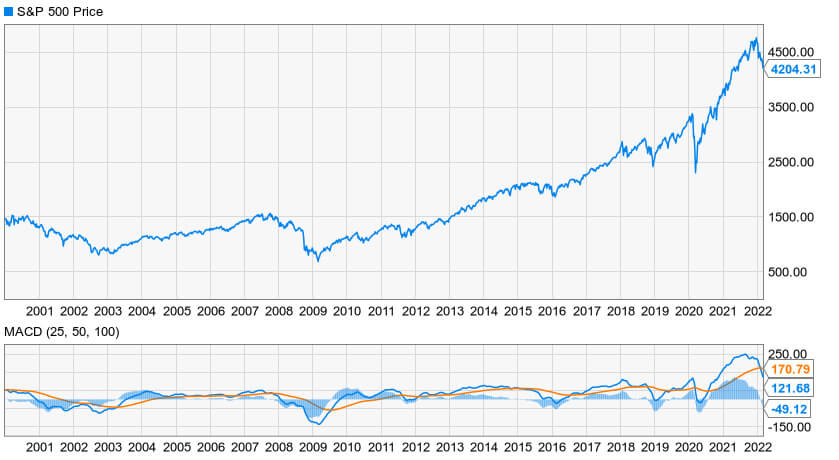

In that September of 1939, the S&P 500, far from losing ground, actually advanced 16.5% during the month. If you’d rather look at America’s entry into the war, then it’s worth noting that the S&P 500 dropped 10.3% in December of 1941, the month the Japanese bombed Pearl Harbor. But regardless of when you say WW2 started, the bad news for U.S. stocks ended in May of 1942 when the S&P hit its low point. By the way, it has been trending up ever since. To be sure, stock market corrections and bear markets are going to happen, but over the long term the markets almost always go up.

But since the markets have to navigate bad news along the way, let’s take a look at how the markets have reacted to stressful events over the past several years.

War, and more

The Korean War is generally reckoned to have started in June 1950 and to have ended – to the extent it ever ended – in July 1953. Over that time, the S&P 500 rose 31.8%.

Let’s set the start and end points for the Vietnam War as August 1964 and March 1973 – the Tonkin Gulf incident and the final U.S. military withdrawal, respectively. When those dates are used as the bookends to the Vietnam War, you’ll find that there was a 36.5% advance in the S&P 500 over that period.

The assassination of President John F. Kennedy tells the same story. The S&P 500 fell 1.1% during November of 1963, the month he was killed in Dallas, but the market hit a record high that December.

We all know where we were on September 11, 2001. Amid global panic and shuttered exchanges – not to mention the sheer loss of life within the financial community – the S&P 500 lost 8.2% that September, but it resurged within a few months. The recovery didn’t last long, and 2002 is remembered by many as a particularly off year for Wall Street. That said, if you had cashed out at that time and stayed out, you would likely have missed out on the huge bull market run of 2003-2007.

We also know where we were – and by that, we mean where we were stuck for months on end – during the Covid-19 pandemic. The S&P 500 ended January 2020 at 3225.52. Over the course of the next two months, as hundreds of thousands died worldwide and the global economy essentially stood still, the S&P 500 plunged 19.9%. However, it was back to its winning ways within only a few months.

In sum, the Covid-19 pandemic reordered investment priorities, but barely affected investments indexes. Let’s compare that to the 1957-1958 flu pandemic, which triggered a pronounced recession and bear market. That flu virus reached America in May of 1957 and, by the end of the year, the S&P 500 had plunged 16.5%. The market wouldn’t regain full strength until April 1958. But, as long as that down market period must have felt like at the time, it’s barely more than a footnote in the history of the U.S. stock market.

And remember August through October of 2017, when Category 4 hurricanes hit the U.S. mainland on a monthly basis? That was the summer and early fall of Hurricanes Harvey, Irma and Maria. You’d be hard-pressed to find a stronger 90 days in U.S. stock market history than those three months in 2017.

Guns and butter

In fact, the only catastrophes that the stock market didn’t swiftly rebound from were the ones you’ve probably already guessed: The Great Depression and The Great Recession. The S&P 500 peaked at 31.71 at the end of August 1929 and it wouldn’t surpass that mark until September 1954, a period of more than 25 years! During the Great Recession, the S&P 500 peaked at 1549.38 in late October 2007 and wouldn’t see that figure again for another five-and-a-half years.

But those periods of market losses weren’t wars. And although they had components of natural disasters – the Dust Bowl of the 1930s, and 2012’s nationwide drought, then Hurricane Sandy’s onslaught of the East Coast – those were only part of the story. In terms of magnitude, these events were historically terrible for the markets. But on a structural level they were just parts of the ongoing economic cycle.

And that’s what you really need to worry about when you’re evaluating your investments. Markets and economies are very resilient and come back from wars, famines, floods and other natural disasters. Remember that.

In the meantime, consider how you can help those in need due to the conflict in Ukraine and understand that this war will inevitably lead to personal and economic losses around the world, at least to some extent. But when it comes to your own financial interests, it is best to consult with a trusted advisor rather than play armchair general with your investments.