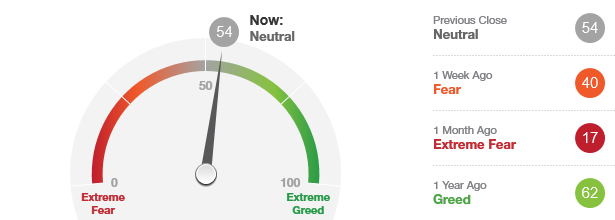

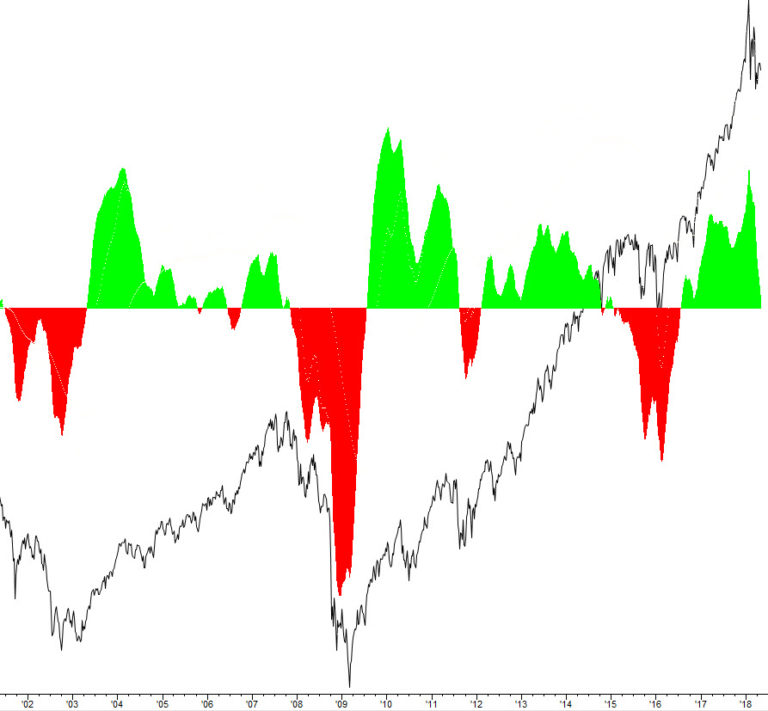

Market Overview

This month’s models are now available.

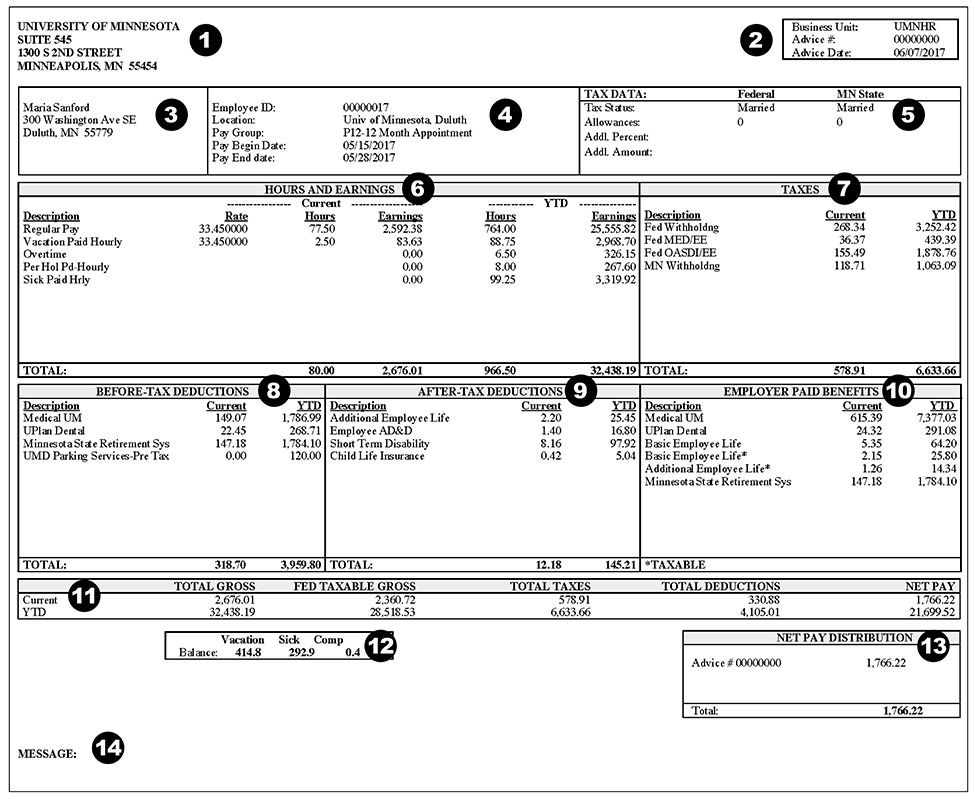

Does your paycheck need a health check?

In any given year, it’s good practice to take a look at your payroll deductions. But it’s even more urgent now, considering the seismic shift in tax policy from 2017 to 2018.

Credit: Clifford K. Berryman, 1928

The Tax Cuts and Jobs Act of 2017 might reduce your tax burden and is intended to simplify your filing. But if you’re underwhelmed by the few dollars extra in your monthly net pay, there are things you can do to help your own cause.

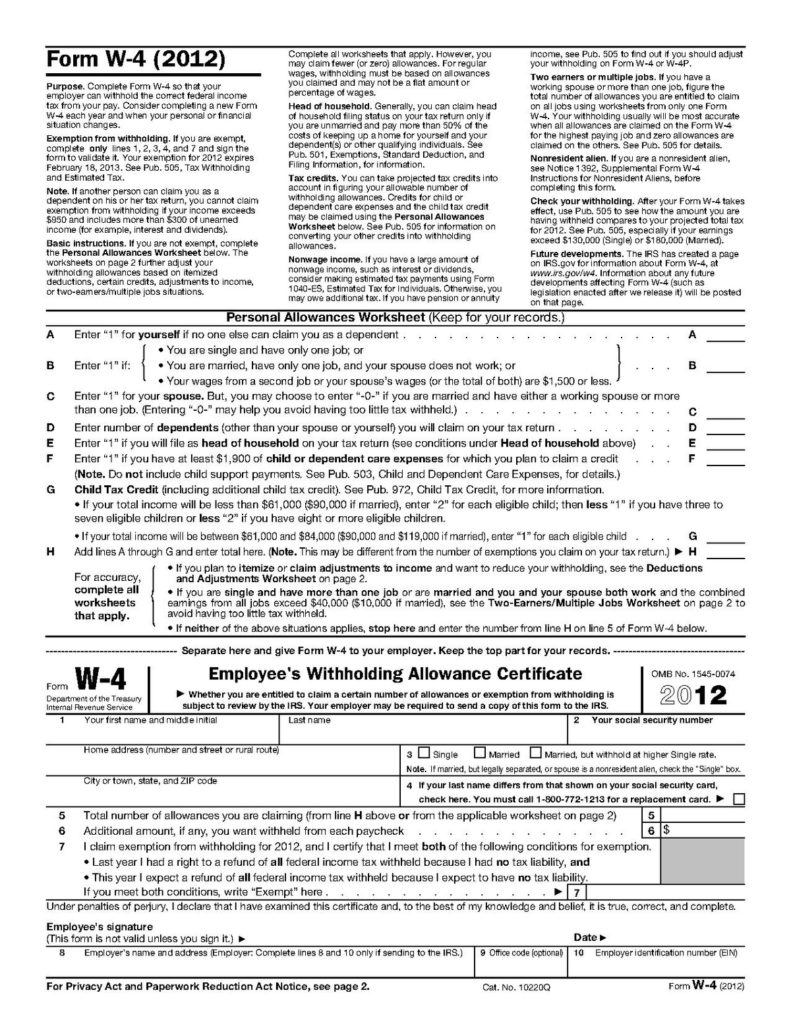

Do you recall filling out a huge stack of forms on your first day on the job? Of all the papers, the one that has impacted you the most over the years was IRS Form W-4. By following a stepwise calculation, you determined what proportion of your pay you wanted to send to the tax collector to ensure no misunderstandings at the end of the year.

This calculation involved your marital status, your number of dependents and other special considerations. At this point, you should be asking yourself two questions:

- Has my personal situation changed since I took this job?

- Have I ever updated my W-4?

If you’re like many people, you answered:

- Yes

- No

It’s possible you’re claiming too many allowances and, thus, having too much money withheld. Maybe it’s time to call Human Resources and see if your W-4 needs updating. You could get a significantly higher amount every pay period by dedicating only a few minutes to this task.

The average income tax refund exceeds $3,000, and the average family who receives it is overjoyed. But, then again, the average family is a little naïve when it comes to money. The U.S. Treasury isn’t handing them a $3,000 gift. It’s returning the $3,000 the family lent Uncle Sam interest-free over the past tax year. Wouldn’t that family have been better if they had had another $250 of their own take-home pay to spend each month?

Social Security and Medicare: No change

Paying into Social Security and Medicare is mandated—for everyone—under the Federal Insurance Contributions Act (FICA). To pay towards Social Security benefits, 6.2% of your gross pay is withheld, and your company matches that amount dollar-for-dollar. The inflation-adjusted cap on how much gross income can be taxed for Social Security just ticked up to $128,400. The other part of FICA covers Medicare, which can get at an additional 1.45% from your gross pay if you as an individual earn up to $200,000 ($250,000 for a couple). For all gross pay above the threshold, the tax rate applied is 2.35% of gross pay. As with Social Security, this is matched by your employer.

The money you contribute to Social Security and Medicare isn’t set aside in an account for you awaiting your retirement. No, your amount withheld goes immediately to current beneficiaries, as you pay for the privilege of living in a country where the typical old or sick person isn’t begging for handouts on the street corner. You’re also trusting in the proposition that, when you become old or sick, a new generation of wage earners will shoulder the burden for you.

If this system doesn’t sound like a bulletproof retirement plan to you, we agree. Read on.

… and the rest

Unless you live in the state income tax-free states of Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming, you’re not done paying income taxes yet. Residents of New Hampshire and Tennessee might have to pay levies on interest and dividend income even though there’s no tax on wages. But everyone else, from Pennsylvanians paying 3.07% of gross pay to Californians paying 13.3%, has to pay for the luxury of living in their chosen tax jurisdiction. You might want to consider just how fond you are of Bakersfield.

Credit: University of Minnesota

But there are other items we generally choose to pay for from pre-tax dollars, such as life, disability, and health insurance. This arrangement works for two reasons. First, it helps us with budgeting and ensures that we make these payments without thinking. Second, these pre-tax payments reduce our income from the IRS’s perspective and could lower our tax burdens.

Lastly, there’s your retirement plan. You might have a defined-benefit pension, a defined-contribution 401(k) plan, or both. It’s best to have a discussion with a financial advisor to see if you’ll be ready to retire on schedule and in comfort.

Your advisor might also have some ideas for more active retirement savings, as this month’s Captain’s Table column discusses more fully.