Market Overview

Home, sweet tax haven

We saw this recently and had to show you:

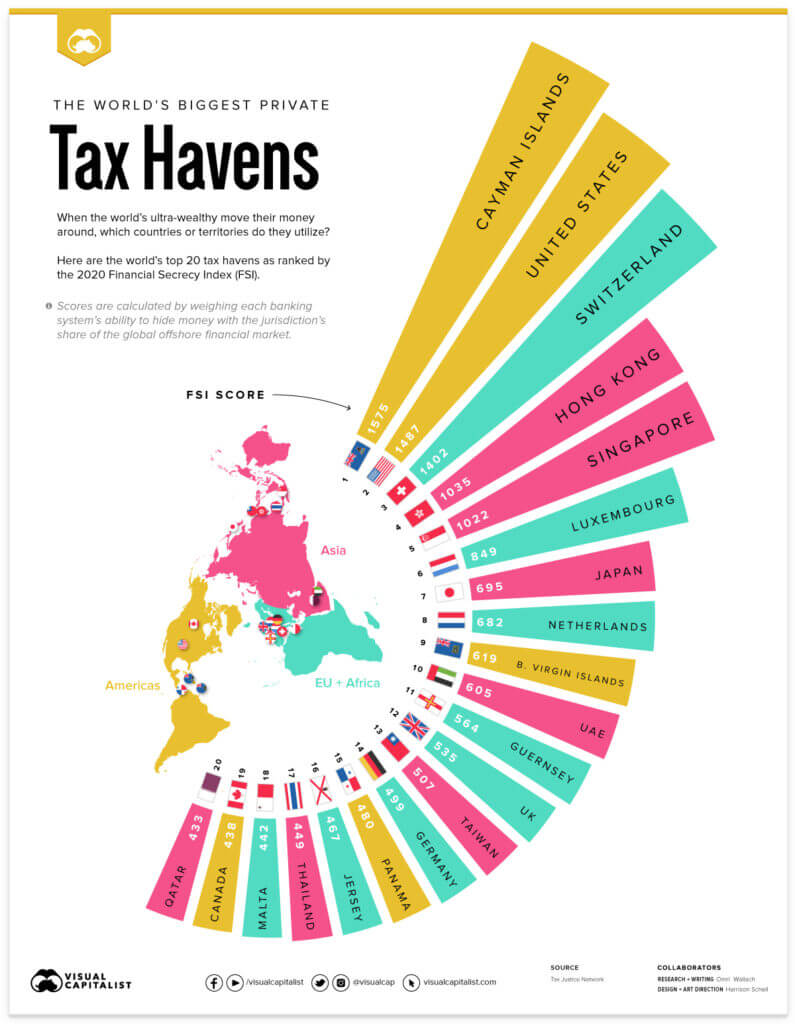

The world’s biggest private tax havens. Credit: Visual Capitalist

You probably didn’t know it, but the United States is the biggest private tax haven in the world, save for the Cayman Islands. Rich people prefer to park their money here rather than in Malta, Luxembourg, Singapore or even Switzerland. This is according to the Financial Secrecy Index (FSI), a publication of the Tax Justice Network.

As much as we like to moan and complain about the taxes we pay here, maybe we’re getting a bargain. There’s certainly a lot of privacy thrown in for free.

Taxes aren’t necessarily lower here

Let’s be clear, what we’re measuring is financial secrecy, not marginal tax rates. Also, this doesn’t apply to corporate tax havens, which feature the Netherlands, the United Kingdom and most famously, Ireland. Apple shifted its profits there in 2015 in a move described at the time by Nobel economics laureate Paul Krugman as “leprechaun economics”.

That said, U.S. residents are not all that highly taxed compared to their counterparts around the world, according to World Population Review. We rank 43rd highest in the world, at 37.0%, the same as Zambia and Namibia, compared to a global average of 28.7%. It bears mentioning that we’re one of only 13 countries without a national sales tax.

The FSI isn’t, as widely believed, a purely quantitative metric at all. National financial secrecy is difficult to measure. Thus, it’s a ranking that depends on subjective, qualitative inputs.

Measuring secrecy

“Qualitative data based on laws, regulations, cooperation with information exchange processes and other verifiable data sources, is used to prepare a secrecy score for each jurisdiction,” according to its methodology description. “Quantitative data is then used to create a global scale weighting for each jurisdiction, according to its share of offshore financial services activity in the global total.”

The document goes on to describe how the sheer scale of the U.S. economy weighted it toward the top of the stack.

It should be noted that the Tax Justice Network doesn’t consider a high FSI score to be a compliment. In fact, it says it is measuring the “harm” that each of these jurisdictions is doing to the global economy.

Whether or not financial secrecy is good or bad, it’s real and individual Americans can benefit from it in ways that citizens of most other countries cannot. As for concrete ideas on how to take advantage of this privacy layer, it’s best to consult a financial professional.