Market Overview

This month's models have been posted. There are CHANGES in ALL MODELS. The rest of the newsletter will be available by the middle of the month.

Old and in the way

You know about “The Greatest Generation”: the cohort raised during the Great Depression who went on to fight World War Two and then launched the amazing economic miracle of the 1950s and ‘60s.

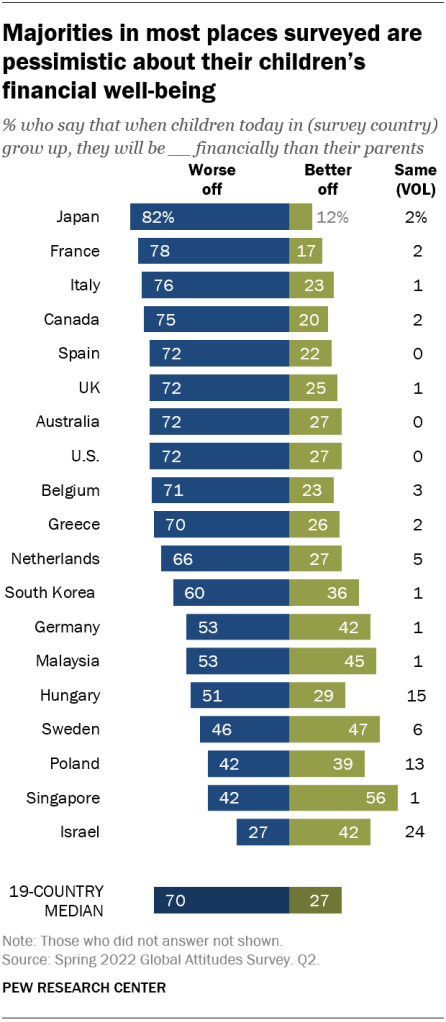

But consider this: Those of us here today, raised during the Cold War, endured the Great Recession, a 20-year stalemate against Islamist extremists, a global pandemic and more natural calamities than we’re inclined to list here. We’ve seen at least as much stuff as “The Greatest Generation”. But, while our parents saw a tremendous surge in their standard of living over the course of the mid-20th century, that perk has eluded us. According to a 2022 Pew Research study, 70% of adults believe their children will be worse off financially than they themselves are. While the U.S. findings were right in line with the aggregate, the view was even bleaker from Japan, France, Italy and Canada.

Will those of us now planning for retirement be the last ones to ever do so?

The kids are not alright, if you ask their parents. Credit: Pew Research Center

The Old World

Much of the world is aging. China wasn’t included in the Pew study. Still, Chinese life expectancy increased from 44 years to 78 over the past 60 years, according to the World Economic Forum. China expects the number of people 60 and over to rise from today’s 280 million to more than 400 million by 2035, which is equal to the entire current populations of the U.S. and the U.K. combined.

As the population gets older, two things happen. First, there are relatively fewer working-age people to support the retirees. Second, and closely correlated, there are relatively fewer childbearing-age people to replace the retirees in the work force. The Beijing government has no one else to blame – remember the One Child Policy? – but China’s population declined in 2022 for the first time in six decades. As a result, what had historically been the most populous country on earth will be eclipsed this year by 1.4 billion-strong India.

At present, each Chinese retiree is supported by the contributions of five workers, according to the WEF, half the ratio of a decade ago. This is clearly unsustainable.

India doesn’t appear to have that problem. The World Bank says those 65 and older comprise only 6.8% of India’s population, compared to 13.2% of China’s.

That begs the question: How does the U.S. compare? The answer is, not very well at all. The 65+ crowd is an even higher proportion of Americans – 16.7% -- than of Chinese. In 2022, there were an estimated 2.8 workers per retiree, according to the Social Security Administration. By 2035, that’s expected to drop to 2.3 covered workers for each beneficiary.

The fact that Canada and most of western Europe are even worse off is cold comfort.

Buying the Stairlift to Heaven

The aging of America, and indeed the industrial world, will have profound impacts on specific industrial sectors. Which ones, though? That is highly dependent on what public policies are established to deal with the decreasing ratio of workers to retirees.

If nothing is done, the trust that funds a portion of Social Security benefits will dry up in 10 years. Checks will keep coming, but they’d probably lose about a quarter of their value. That’s because benefits would have to be paid 100% out of the contributions of current workers rather than a blend of those contributions and trust fund payments, according to Forbes Advisor.

To stave off reduced benefits, we as a nation need to decide if we’re going to increase the retirement age, increase the Social Security tax on the wealthiest taxpayers, increase that tax across the board, or implement some combination thereof. We might also consider ways to increase the number of people working in the formal economy and thus contributing to the Social Security fund. This can be done by increasing the retirement age, taxing gig workers, offering parents financial incentives to have larger families or coming up with an immigration plan that would turn today’s illegal aliens into tomorrow’s taxpayers. Again, the optimal solution would probably be a combination of all of these.

When you consider that both frontrunners in the 2024 presidential race are at an age where buying green bananas is considered by many a bold act of optimism, and that they have widely divergent views on just about everything, it becomes clear that nothing is settled.

Whichever way that race goes, it might be a good idea to talk with a trusted financial advisor to make sure that your money survives you, and that your survivors have a better-than-average chance of success in their own lives.