Market Overview

Since the last newsletter, the markets as a whole have seen unprecedented policy-related volatility. On a year-to-date basis the S&P 500 is down -6.06%, the DJII -5.71% and the NASDAQ Composite is down -9.98%. Despite recent market turbulence, USPFA model portfolios remain well positioned and diversified. We continue to believe it is important to stay the course during periods of volatility, but are also prepared to make adjustments if markets conditions warrant.

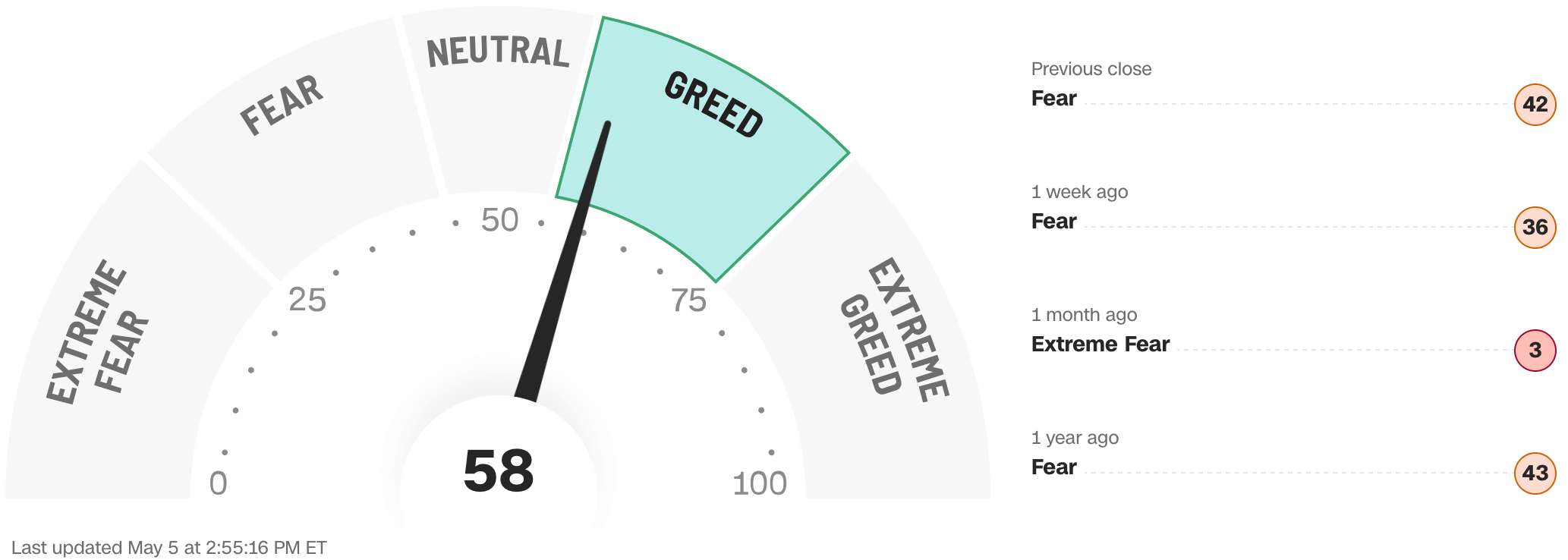

Throughout April, financial markets experienced almost unprecedented volatility, driven largely by shifting government policies related to international trade, uncertainty around Federal Reserve leadership and future monetary policy, renewed inflation concerns, and growing fear of an economic slowdown (aka: recession).

Key Drivers of April Market Volatility:

- Tariff Announcements: On April 2, President Trump announced new worldwide import tariffs ranging from 10% to 57%. Key U.S. trading partners were hit hardest, including China (45%, later raised to 145%), Vietnam (47%), Bangladesh, and others.

- Temporary Relief: On April 8, a 90-day pause on tariffs for all countries except China was announced, causing a brief market rally. However, realization of the deep U.S.-China trade ties quickly reversed gains.

- Sector-Specific Swings: Temporary exemptions for products like smartphones and semiconductors led to sharp sector movements, depending on policy shifts at any given time.

- Federal Reserve Tensions: Markets fell when President Trump publicly criticized Fed Chair Jerome Powell, threatening the Fed’s independence. Markets partially recovered after the administration softened its stance.

Looking Ahead:

USPFA subscribers should ensure that you are invested at a level that allows you to stay the course confidently and maintain a long-term perspective rather than reacting to short-term fluctuations. History has shown that disciplined investors who stick to their strategy, rather than react emotionally to short-term movements, tend to see stronger long-term results. Stay patient, stay invested, and stay aligned with your financial goals.

What We’re Watching

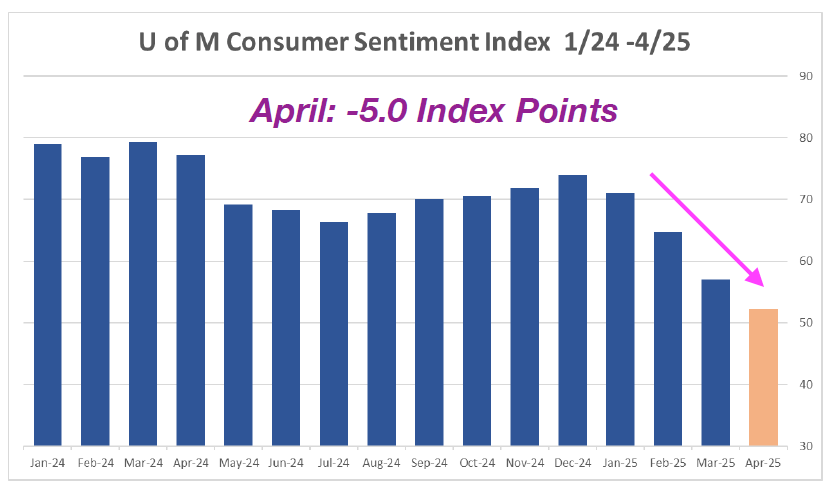

Index of Consumer Sentiment

US Consumer Sentiment, as measured by the University of Michigan Index, fell for the 4th straight month, plummeting another 8% from March, and is now down more than 32% since December, the steepest decline seen since 1990’s recession. Expectations worsened across age, education, income and most notably, political affiliation. Perceived risks include uncertainty about trade policy and an inflationary resurgence, as well as bleak expectations for the labor market. Of specific concern is weakened anticipated income growth, which is expected to suppress consumer spending.

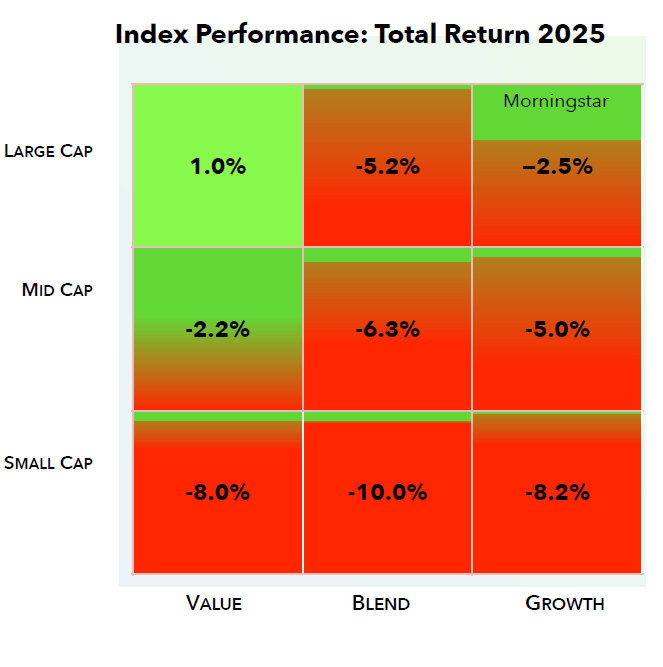

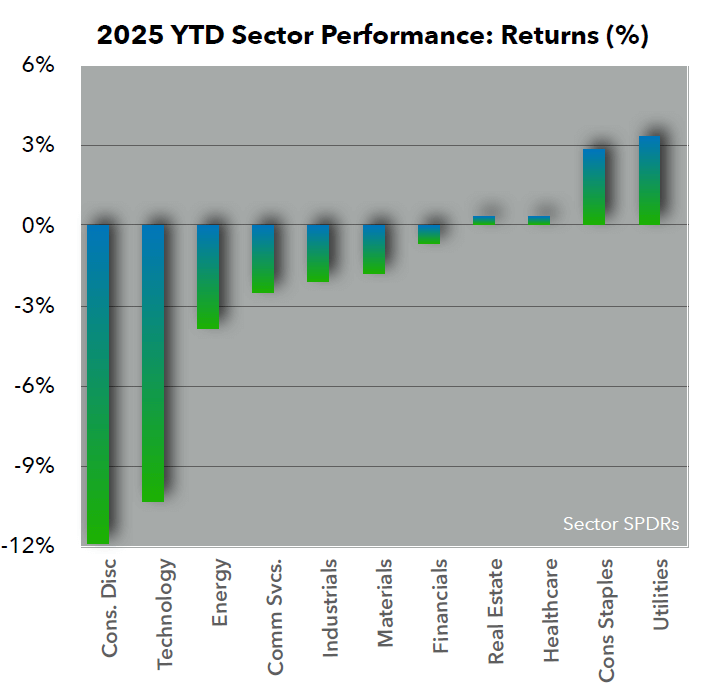

Index and Sector Analysis:

Indices: Market volatility spread throughout the indices. The only index quadrants higher since the last USPFA newsletter were Large and Mid-Cap Growth, mainly on executive branch announcements that certain sectors & products will avoid tariffs (smartphones, computers, chips and other electronic goods, and then later automobiles and certain auto parts). All other indices were down, with the Small-Cap indices down YTD over 8% across the board.

Sectors: The volatility in the market has resulted in a defensive pivot, as historically defensive sectors Utilities, Cons. Staples, Healthcare and Real Estate are the only sectors up YTD. Utilities (up 0.3% since the last USPFA Newsletter) is now the best-performing sector YTD, followed closely by Consumer Staples (up 0.5%). The only other sector that posted a gain in April is Technology, bolstered by the exclusion of many high-technology products from the tariffs imposed by the executive branch. Laggards include Energy (from tariff-related economic slowdown and recession fears), and Healthcare (due to tariff threats on Pharma imports, a potential shift in Medicare reimbursement policies and mixed earnings report from Gilead (GILD) and Centene (CNC).

Fixed Income Market Update

Fixed income markets in April showed extreme volatility, with sharp daily moves often reversing within hours. Similar to the equity markets, fixed income prices and yields swung in response to policy headlines and remarks from President Trump or his staff, whether delivered through press conferences or social media posts. Adding to the instability, responses from other countries — including threats of retaliatory tariffs and trade barriers — amplified market uncertainty. Each new announcement sent ripples through both stock and bond markets, contributing to rapid shifts in investor sentiment and heightened uncertainty. As a result, April was one of the most volatile months for fixed income in recent memory, with investors struggling to find stable footing amid the constant flow of political and economic developments.

Economic data in April added to the market’s crosscurrents. Inflation reports showed mixed trends: while headline CPI (consumer price index) remained stubbornly higher than desired, core inflation measures (excluding food and energy) showed slight signs of easing. Producer price data (PPI) also indicated some upward pricing pressure, complicating the Federal Reserve’s path forward. The Federal Reserve continued to emphasize a patient, data-dependent approach, with Chair Powell and other officials stressing that they need more evidence of sustainably lower inflation before cutting rates. Futures markets adjusted accordingly, now pricing in fewer and later cuts than earlier this year. Traders are now betting on one to two rate cuts by the end of 2025, down from expectations of three cuts just a month ago.

Through all of the mid-month volatility, US Treasury yields continued their downward trend, especially on the short-end. In what sounds remarkably tame after such a volatile month, the 2-year yield ended up down by 17 basis points (3.912% to 3.744%) signaling a stronger adjustment in short-term interest rate expectations. Meanwhile, the 10-year yield ended up almost unchanged (down just 1 basis point to 4.24%). This reflects a tug-of-war in market sentiment: while long-term growth expectations have softened from rising recession fears, concerns about higher inflation tied to President Trump’s proposed tariffs have kept longer-term yields from falling more sharply.

Overall, April reinforced that the fixed income environment remains highly sensitive to political risks, inflation trends, and monetary policy shifts. It is important to note, however, that the yields being held in check show that the neither the market volatility nor government policy has yet to dampen continued demand for US Treasury debt. We at USPFA are closely monitoring Federal Reserve signals, incoming economic data, and evolving market sentiment as we navigate the months ahead.

Corporate Earnings

A multitude of companies reported their fiscal Q1 results during April. With the caveat that Q1 results do not reflect the market disruptions from tariff policy changes, the blended net profit margin for the S&P 500 is 12.4% which is above Q1 2024 and reflection the fourth consecutive quarter that the S&P is reporting a net margin above 12%.

Alphabet (GOOG) rose on Friday before this newsletter as it reported strong Q1 earnings that beat expectations, a 5% dividend increase and $70B of stock buybacks. Its strength boosted technology stocks across the board.

Goldman Sachs (GS) last Monday posted Q1 results that exceeded consensus estimates due to strong equities trading revenue, but this masked some weakness in other areas of the bank including asset and wealth management. Morgan Stanley (MS) similarly topped Q1 estimates also on the back of strength in its equities trading division.