Market Overview

This month's models have been posted. The rest of the newsletter will be available by mid-month. There are CHANGES in all the models.

What not to do when both stocks and bonds falter

Don’t panic.

There. That’s the biggest takeaway.

But if you’d like some assurance that stocks and bonds have fallen in tandem before and it wasn’t the end of the world, or if you’d like some thoughts on where you can park your money until this all sorts itself out, read on.

Even the Brooklyn Daily Eagle survived the Great Depression. (It ceased publication the week Eddie Van Halen was born in 1955, but there’s probably no causal relationship.) Credit: Goldman Sachs

We’ve all learned about the financial impact of the Great Depression. In the two-and-a-half years following the October 28, 1929, crash, the Dow Jones Industrial Average plummeted almost 90%. Bond values rose, as most models would predict, over a similar span by about 13%.

“Obviously, stocks did horribly during the Great Depression. But bonds did well,” according to the website for public broadcasting outlet Marketplace. “Interest rates and bond prices are two ends of a seesaw. When bond yields are rising (usually from investors anticipating higher inflation), bond prices go down–and vice versa. Bond prices soared as bond yields came down sharply during the depression.”

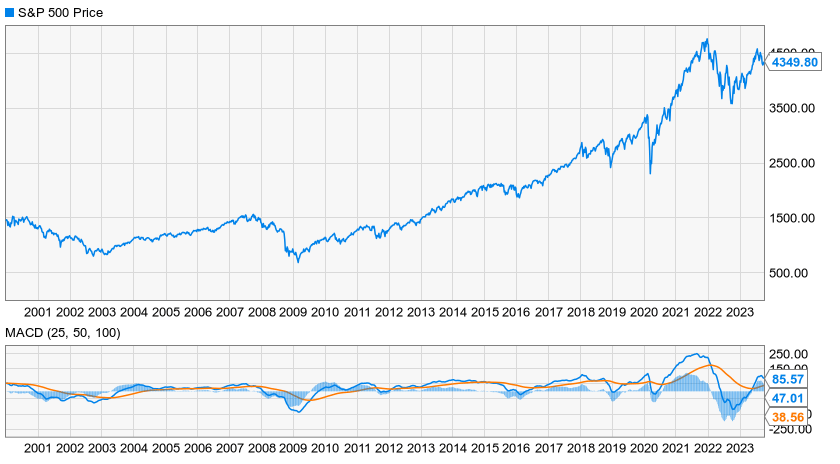

Equities took a dive in more recent memory as a result of the Great Recession. Between December 2007 and June 2009, The S&P 500 tanked 38% and, again predictably, bond values surged 23%.

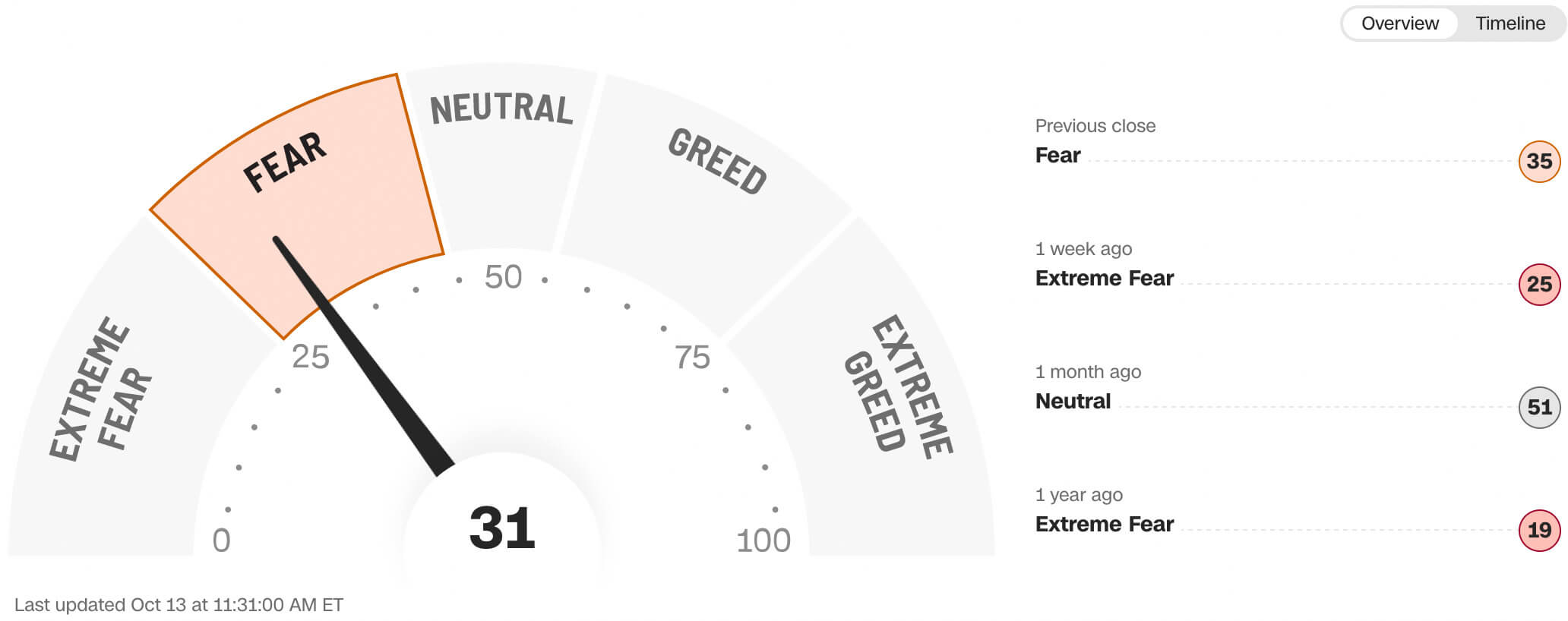

Which brings us to today, when the model is seemingly breaking down before our eyes. Equities have lost about 8% of their value since their late-July peak. Meanwhile, the value of the benchmark 10-year Treasury bond has declined by almost a quarter. Since the start of the Covid 19 pandemic in March 2020, Treasury bonds with a maturity of 10 years or more have plummeted by almost half.

‘It’s different this time’

While Marketplace’s “seesaw” has generally held as a good analogy, it doesn’t universally hold.

“For most of the past 20 years, stock prices and bond prices tended to move in opposite directions. This made buying 10-year Treasury bonds a good hedge for investors seeking to protect their portfolio from declining stock prices,” according to researchers at Harvard University and the University of Chicago. “But when the Federal Reserve started raising interest rates to fight inflation in 2022, the prices of stocks and bonds fell simultaneously. This was more akin to the norm during the 1980s and 1990s when stock and bond prices tended to rise and fall in tandem.”

They cite an academic paper that predicted our current situation back in 2017.

It’s important to note that stocks and bonds react to different stimuli. With stocks, it’s all about a company’s expected profits – both their magnitude and their timing. Some are more tightly entwined with the broader economy, some less so. Some peak early in the economic cycle while others, depending on their industrial sector, peak later. And of course, the perceived quality of management determines how one company is likely to perform against others in its industrial and geographic peer group.

That’s not the story with bonds. They are largely driven by three – mainly macroeconomic – factors, according to J.P. Morgan:

- Inflation,

- Growth,and

- Uncertainty.

We are currently experiencing all three – J.P. Morgan emphasizes uncertainty – which drives up yields. Higher yields lower the value at which the bonds are bought and sold.

What’s wrong with this picture

One thing that is wrong with this analysis, though, is any discussion of bond prices. Frankly, nobody cares about that. The value of a bond is expressed in its yield; as yields go up, the value of the bond goes down.

Unless you’re planning to buy or sell bonds soon, the value is irrelevant. You still get the same coupon payments on the same schedule as you did when you took possession. You’re still getting the same interest rate.

Of course, you’re not getting as high a rate as you would get from a bond newly issued during a period in which greater yields prevail. If you were to buy a new bond with a bigger coupon payment, you would continue to get that benefit until that security is retired. So even when prevailing interest rates drop back down to normal, you’ll still be getting above-normal returns from your fixed-income investments.

Repeat: Don’t panic.

Generally speaking, it’s best to filter out hiccups in the market and stick with the plan you’ve meticulously crafted with guidance from an experienced financial professional.

“When your stocks plummet, it’s human nature to want to cash out—to unload the whole batch of them before equities go to zero. If you do, though, you’ll only harm yourself, because they will come back,” a Fortune magazine article recently counseled. “During the 2008-09 horror show, the S&P 500 lost around half its value. It took a little over two years to recover. But the point is that it did recover. And stocks never were in danger of going to zero. A fall to zero didn’t even happen during the Great Depression.”

One Wall Street Journal article boiled down the received wisdom to two words: “Do nothing.”

Still, that doesn’t mean that a course correction might not be in order.

Mike Tyson is not, to the best of our knowledge, a licensed financial advisor of any kind. Still, his famous advice – “Everyone has a plan until they get punched in the mouth” – resonates. You have to expect to get punched in the mouth once or twice but, if it becomes a habit, you might need to change tactics.

The Harvard-Chicago academics point out that, if bond prices move in tandem with stock prices, that means you may have to rethink their role as a hedge in your portfolio, which could mean altering the risk in your portfolio.

For some, it might make sense to shift more into fixed-income investments in the current environment. If you choose to increase your exposure to fixed-income in your portfolio, you need to consider what proportion to hold in short-term instruments and what proportion should be in longer-term bonds.

The question then becomes, “Is this the new normal?” If your investment thesis is that this is the new normal, it might be time to adjust the game plan. Alternatively, if you believe this is just a quirk in the second half of 2023 and things will regress back to the mean as they tend to do, then you might just want to spit out that loose tooth and get back in the fight. Either way, it almost always makes sense to have a trusted financial advisor in your corner.