Market Overview

This month's models have been posted. .

The new China syndrome: economic meltdown

The Chinese economy of 2023 is in bad shape. This surprises very few people, and has been both predictable and predicted since 1979, when the then-most populous country in the world imposed its one-child policy.

Initially introduced to combat the perceived threat of overpopulation in the news at the time, it has proven to be, at best, a gross overreaction. Not only was the policy based on predictions that, according to a 2000 National Research Council study, were already overstated by 18%, the Chinese also took a textbook footnote by 19th-century economist Thomas Malthus way too literally.

“Malthus argued that … the population was growing far faster than the ability to grow food. By this thinking, the future would be a bleak hellscape of rampant starvation,” we noted in this space last year before concluding, “Malthus was, as it turns out, dead wrong.”

Meanwhile, the economic impact of having two retirees for every worker proved inevitable.

“Population aging will be a permanent major drag on China’s economy,” according to one widely quoted Chinese economic observer, Yi Fuxian. “After all, as Italy’s experience shows, the old-age dependency ratio (the number of people over 64, divided by those aged 15-64) has a strong negative correlation with GDP growth, as does the median age and the proportion of people over 64.”

It’s important to note that Yi is not an economist. He’s an obstetrician.

This adorable family is part of the reason China is failing now. Credit: China.org

While there were any number of ways for a family to get around the one-child policy, and the limit was raised to two children in 2015, and to three in May 2021, by the time all family size restrictions were repealed in July 2021, the damage had been done. What damage? This damage.

Damage done

Here are the bullet points of China’s economic woes:

- Unemployment: In August, Beijing released its monthly unemployment rate for Chinese citizens ages 16 through 24. It came to 21.3%. Authorities have announced they won’t be tracking that anymore. For the whole work force, the rate is 5.3%, or around 1.5 percentage points higher than it is here in the U.S.

- Deflation: While the opposite of inflation sounds like it would be a welcome change to most Americans, deflation is actually bad news over the long term. It means that faith in the economy is dissolving; people aren’t spending money because they’re worried about the future. The inflation rate in China is currently -0.3%.

- Weak currency: The yuan is now worth less than 14 U.S. cents, a 16-year low.

- Cratering real estate: The first quarter of 2023 and the full year of 2022 were devastating to the Chinese real estate market. It wasn’t unusual for new home prices to decline a percent-and-a-half per month. Meanwhile, cities are becoming overbuilt with commercial space as office vacancy rates climb and prices per square foot plummet. This land rush is the result of the government’s imbalanced investment portfolio. Authorities went big on real estate but spent barely anythingon producing consumer goods.

- Bankruptcies: Collectively, property developers are carrying around $390 billion in debt. One of the biggest debtors in the Chinese real estate game, Evergrande, filed for bankruptcy protection under U.S. law last month. Another, Country Garden, is on the brink. And while real estate insolvency captures headlines, it’s not the whole picture. Recently, half a million or more Chinese industrial companies have been going out of business every three months. This could have ripple effects on supply chains all around the world.

- Trade barriers: China is very protective of its industries and is known to be quick on the draw when it comes to tariffs – like it imposes on auto imports – or quotas – like it imposes on around 40 different commodities. But there are less direct ways to reduce competition from the U.S. or elsewhere. Witness the recent decision out of Beijing to insist that government officials may no longer use iPhones. This multimillion-unit market would then default to Apple’s leading Chinese competitor, Huawei. Of course, when a country puts up import barriers, other countries often retaliate with barriers of their own. That will likely make it hard for Chinese manufacturers to sell their goods abroad, further weakening their own economy.

Possible fixes

Despite all this doom and gloom, China’s economy is still growing at a 5.5% annual clip. While that’s impressive by the standards of a developed economy, despite being a military, technological, cultural and industrial superpower, China is economically just a really big emerging market. As such, that’s barely half the gross domestic product growth it’s accustomed to.

Some would say that China’s underlying problems aren’t economic. They’re political.

“The present challenges in the Chinese economy can largely be attributed to the impact of state interventions on market confidence. The government has been pushing ambitious social agendas, from the stringent zero-covid policy to antitrust crackdowns on large tech firms and the pursuit of ‘common prosperity,’” according to Wei Xiong, a Princeton University economics professor. “This has dampened entrepreneurial vigor, making business owners reluctant to embark on new ventures, even in an economy with substantial savings and liquidity.”

Wei’s prescription is for Beijing to bail out the property developers and provide incentives for homebuyers. His recent article in The Economist also suggests that money be channeled through local authorities to provide one-time “consumption vouchers” akin to the stimulus checks Americans received during the Covid-19 pandemic. However, these proposed measures are short-term fixes.

“In the longer term, structural reforms are needed to address moral hazards and promote fiscal responsibility,” Wei continues. “At the top of the list should be reforms that promote affordable housing, reduce local governments’ reliance on land sales for fiscal revenue and make their debt transparent.”

He further suggests that the government stop promoting state-owned enterprises at the expense of private companies.

And now, the bad news

What makes all this worse for the average Chinese citizen is that, since Xi Jinping became paramount leader 10 years ago, he has chipped away at the social safety net. While this might make sense from a libertarian point of view, why would a communist do this? Setting labels aside, it makes little sense in this specific case from a public policy perspective. Working age people are scrambling for jobs as companies go bankrupt or scale back operations. Each worker now has the burden of supporting 2.26 retirees, a situation likely to degenerate further over the next 20 years. Those retirees are having their pensions cut. Healthcare benefits are also being constrained. In other words, the situation could get far worse before it gets better.

But let’s not forget, we’re talking about the world’s second-largest economy. Whatever rivalry we have with the People’s Republic of China, we really do buy a lot of stuff from the Chinese, and they buy a lot of stuff from us. Last year, we spent $536.8 billion on imports from China, according to the Commerce Department, while China loaded up on $153.8 billion worth of U.S. goods. While this constitutes an overall trade deficit from the U.S. perspective, agricultural goods are the exception. China is the most important overseas market for American farmers.

But that’s just the balance of trade for goods. When it comes to services, which have much higher margins, it’s China that’s at a deficit relative to the U.S. We net somewhere in the neighborhood of $15 billion in financial instruments, information technology, transportation and other services from our relationship with China.

Still, the U.S. has made moves, for both economic and national security reasons, to decouple the giant economies. We have not only been improving trade relations with our long-term allies, but we have also been courting countries historically part of China’s sphere of influence, particularly Vietnam. America has further embraced a public policy to expand our own capabilities in semiconductors and rare earth metals, two of China’s leading exports.

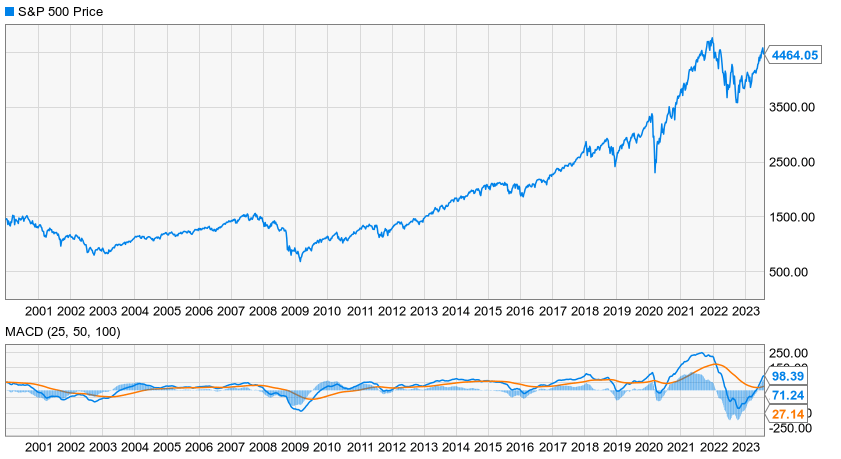

An economic contraction in China would impact countries around the world, including the U.S. While it would cause some hardship here, we are better positioned now than we were just a few years ago. Even so, you would be well advised to consult a trusted financial professional to see how you can insulate your portfolio from this eventuality.