Contrast We celebrate and give thanks each year in November, but this November was a month riddled with somber events all over the world. Friday, November 13th was an especially dark day for those affected by the horrific terrorist attacks in Paris, and Europe as a whole continues to struggle to handle the inflow of

October 2015 Recap

October is always a month of change. For those of us living in the Northern hemisphere, it’s when summer finally gives way to autumn. The colors change. The days get shorter and cooler. It becomes “football weather”. And for sports fans in the U.S., the final week of October is just about as good as it gets: the NFL and college football seasons are in full swing, the World Series is underway, and the NBA and NHL regular seasons are just starting up. The end of October also means Halloween is upon us and the holiday seasons of Thanksgiving and Christmas are right around the corner. For many, this is the beginning of the best stretch of the year. Interesting, Halloween is the second most expensive holiday, after Christmas. According to the National Retail Federation, Americans will spend about $6.9 billion on Halloween this year. That breaks down to $74.34 per person. Americans will spend $350 million alone on costumes ... for our pets! Amazing.

September 2015 Recap

Selenology

Both a lunar eclipse and a super-moon made for a dramatic celestial show on the evening of the final Sunday of September. A super-moon occurs when the moon’s orbit brings it closest to Earth, and a lunar eclipse leaves the moon with a rusty, reddish color.

It’s interesting that only theories explain the creation of the moon. The most commonly accepted theory is that another planetary mass that orbited our sun collided with Earth long ago, and the collision sent pieces of Earth and the other planetary mass into orbit around the Earth, eventually forming the moon. There are obvious ways the moon affects the earth, such as how its gravitational pull causes our ocean tides. There are subtle effects from that ancient collision, like how it caused the Earth to slightly tilt on its axis. Regardless of the moon’s origin, there is no arguing that there is a distinct relationship between the planet we call home and that pale white, barren body orbiting us day after day.

August 2015 Recap

Clarity

Investors are looking for clarity in the face of multiple uncertainties, more uncertainties than most typical investors can bear. What is going on with China? Exactly how strong is the U.S. economy? When will the Fed increase interest rates? And when will oil prices stop sliding? These are all tough questions to answer. In this newsletter, we will start in the East and move West to reflect on market activity in August and our outlook going forward.

July 2015 Recap

The Usual Suspects

Did you know that 2014 was the warmest year on record? Most of the U.S. enjoyed a cooler start for the summer this year, but right now it’s pretty hot for us in North Texas. Still, it's probably not a bad time to go somewhere even cooler in these last few weeks of the summer, a place like Europe where our U.S. dollar buys you more. Looking to the southern part of the Eurozone, great discounts are still available, whether you are considering a vacation there or investing in their markets which are crumbling like ancient architecture. But you won’t beat the heat. In this newsletter, we are going to spend most of our time reviewing last month's themes, as they truly still applied to July.

The default that launched 1,000 headlines

July 2015 Mid-month

Key Points and Market Recap • The drama in Greece may persist for years, but we believe widespread contagion remains unlikely. • The Chinese market volatility and economic decline are growing as issues that warrant investor concern. • Despite the risks, we think the outlook for U.S. economic growth, corporate earnings and equities remains positive.

June 2015 Recap

Drachmas, Dragons and Bears

The summer is usually a time to relax. School lets out, and you don’t have to deal with as much traffic. You might have already squeezed in a vacation or hosted a cookout or two, but the markets have not been so relaxed. Over the past three years both temperatures and blood pressures rose on different issues and news headlines. In 2013, stock and bond prices plummeted violently when the Fed hinted at the end of easy monetary policies. It was dubbed the “Taper Tantrum.” In 2014, it was both Russia “invading” Crimea and Ebola which shook stocks. This summer it’s the debt crises in Greece and Puerto Rico, and the unknown implications of China’s quickly cooling economy and possible stock market bubble. Let’s spend a few minutes to take a closer look at these issues.

May 2015 Recap

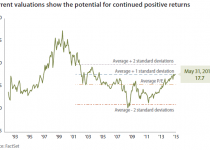

There’s an antiquated stock market adage to “sell in May and go away”. The advice is really the back-end of an old two-step trading idea sometimes dubbed the “Halloween Indicator”. The idea is that the market performs best from November through April (inclusively), and that it’s a good idea to get out of stocks in May and sit in cash through the summer and well into the fall. While studies have shown that this very simple trading maxim actually has some statistical merit, the question a lot of folks have is: when do you sell in May - at the beginning or at the end of the month? Well, in 2015, it would have depended on whose stock market you were invested in. It would have been wise to stay invested in the U.S. stock market through the entire month, but if you had been invested in other stock markets around the world, then getting out at the beginning of May would have probably been best. The U.S. market, as measured by the S&P 500, fared better in May than it did in April, but world stock markets advanced less or were negative, and emerging market stocks posted negative returns for the month. Most U.S. and global bond indexes lost ground as well.

April 2015 Recap

March Madness is in full swing with over 60 games having already been played.People all over the world fill out their brackets in hopes that they can predict the future, including the surprise upsets that turn an “also ran” bracket into a money winner. Those who filled out their brackets by working from the Championship game backwards and opting for favorites like Kentucky, Wisconsin, Duke, and Villanova are feeling rather confident right now. In the world of finance, investors are attempting to do the same thing when it comes to the Federal Reserve Bank’s interest policy. The favorites in this game are the consensus opinions regarding when and how the Fed Funds Rate is going to increase, and that has been June and is now starting to get pushed back to September. Instead of analyzing coaches, rosters and game stats, investors are studying Fed statements, inflation data, dollar strength, unemployment figures and economic measures such as GDP.

March 2017 Recap

What a difference a year makes. Do you recall how 2016 started? The United States’ Federal Reserve announced the first interest rate hike in years in December of 2015, and the S&P 500 would then plummet almost 11% over the following 8 weeks. At the same time, Japan and a number of European countries initiated