Key Points and Market Recap • The drama in Greece may persist for years, but we believe widespread contagion remains unlikely. • The Chinese market volatility and economic decline are growing as issues that warrant investor concern. • Despite the risks, we think the outlook for U.S. economic growth, corporate earnings and equities remains positive.

June 2015 Recap

Drachmas, Dragons and Bears

The summer is usually a time to relax. School lets out, and you don’t have to deal with as much traffic. You might have already squeezed in a vacation or hosted a cookout or two, but the markets have not been so relaxed. Over the past three years both temperatures and blood pressures rose on different issues and news headlines. In 2013, stock and bond prices plummeted violently when the Fed hinted at the end of easy monetary policies. It was dubbed the “Taper Tantrum.” In 2014, it was both Russia “invading” Crimea and Ebola which shook stocks. This summer it’s the debt crises in Greece and Puerto Rico, and the unknown implications of China’s quickly cooling economy and possible stock market bubble. Let’s spend a few minutes to take a closer look at these issues.

USPFA Flash Market Update - Greece

Greece dominates the global headlines right now, and for good reason. While Greece is a small country, its huge debt balances have forced the International Monetary Fund (IMF), the European Commission, and the European Central Bank (ECB) - the three collectively known as “the troika” – to repeatedly save it from defaulting on its debt

May 2015 Recap

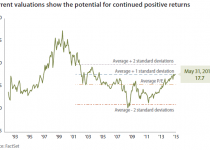

There’s an antiquated stock market adage to “sell in May and go away”. The advice is really the back-end of an old two-step trading idea sometimes dubbed the “Halloween Indicator”. The idea is that the market performs best from November through April (inclusively), and that it’s a good idea to get out of stocks in May and sit in cash through the summer and well into the fall. While studies have shown that this very simple trading maxim actually has some statistical merit, the question a lot of folks have is: when do you sell in May - at the beginning or at the end of the month? Well, in 2015, it would have depended on whose stock market you were invested in. It would have been wise to stay invested in the U.S. stock market through the entire month, but if you had been invested in other stock markets around the world, then getting out at the beginning of May would have probably been best. The U.S. market, as measured by the S&P 500, fared better in May than it did in April, but world stock markets advanced less or were negative, and emerging market stocks posted negative returns for the month. Most U.S. and global bond indexes lost ground as well.

April 2015 Recap

March Madness is in full swing with over 60 games having already been played.People all over the world fill out their brackets in hopes that they can predict the future, including the surprise upsets that turn an “also ran” bracket into a money winner. Those who filled out their brackets by working from the Championship game backwards and opting for favorites like Kentucky, Wisconsin, Duke, and Villanova are feeling rather confident right now. In the world of finance, investors are attempting to do the same thing when it comes to the Federal Reserve Bank’s interest policy. The favorites in this game are the consensus opinions regarding when and how the Fed Funds Rate is going to increase, and that has been June and is now starting to get pushed back to September. Instead of analyzing coaches, rosters and game stats, investors are studying Fed statements, inflation data, dollar strength, unemployment figures and economic measures such as GDP.

March 2015 Recap

March Madness is in full swing with over 60 games having already been played.People all over the world fill out their brackets in hopes that they can predict the future, including the surprise upsets that turn an “also ran” bracket into a money winner. Those who filled out their brackets by working from the Championship game backwards and opting for favorites like Kentucky, Wisconsin, Duke, and Villanova are feeling rather confident right now. In the world of finance, investors are attempting to do the same thing when it comes to the Federal Reserve Bank’s interest policy. The favorites in this game are the consensus opinions regarding when and how the Fed Funds Rate is going to increase, and that has been June and is now starting to get pushed back to September. Instead of analyzing coaches, rosters and game stats, investors are studying Fed statements, inflation data, dollar strength, unemployment figures and economic measures such as GDP.

February 2015 Recap

In January, U.S. stocks posted their biggest monthly losses in a year while bond prices traded higher and market volatility surged mostly due to concerns about the lack of global growth. February experienced almost the exact opposite with U.S. stock markets hitting new highs. The S&P 500 gained 5.49%, the Dow Jones Industrial Average (DJIA) jumped 5.64%, the world’s developed stock markets gained more than 6% (EFA), and emerging markets posted solid returns as well, climbing more than 4% (EEM).

January 2015 Recap

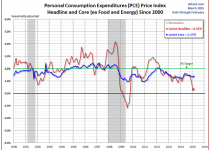

Deflate-gate and Mixed Signals

A “deflate-gate” of sorts hit Wall Street during the final week of January. On Tuesday, January 27th, the U.S. Census Bureau reported durable goods orders, core capital goods orders, and inventories; and overall, the information disappointed. Durable goods were down -3.4%. Capital goods orders were down -0.6%. Inventories increased +0.5%. The following day, the Federal Open Market Committee (the “Fed”) released a statement which pointed out that inflation is “anticipated to decline further in the near term,” and indicated they can be “patient” regarding a federal funds rate increase, but could move quickly if economic data improves sooner than anticipated. On Friday, January 30th, economic growth was reported at 2.6%, which was below estimates. On the same day, Eurostat reported the largest decline in consumer prices in the Eurozone since July of 2009. Equity markets across the globe responded by selling off.

2014 Market Recap

Happy New Year! A new year offers us all the opportunity to look back and make some sense of the year behind us.

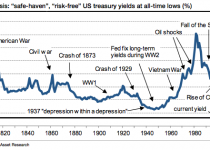

In many ways, 2014 was a year dominated by headlines. Early in the year, a polar vortex swept across the U.S., and as a result, many expected slower economic growth. For the first time, a woman was appointed as chair of the Federal Reserve. Russia engaged in conflict with Ukraine and later annexed the region of Crimea. General Motors recalled millions of vehicles in order to fix faulty ignition switches. Home Depot got hacked. Ebola killed thousands in Africa. Ebola then found its way to the U.S., and markets panicked in response. Oil prices began a steep decline on Thanksgiving. Over the course of the year, U.S. unemployment went down to pre-recession levels. The Federal Reserve’s program, known as Quantitative Easing, officially came to a close. Sony then got hacked. North Korea’s internet went down. Somehow amidst it all, U.S. equity markets reached new highs on over 50 trading days throughout the year.

July 2015 Recap

The Usual Suspects

Did you know that 2014 was the warmest year on record? Most of the U.S. enjoyed a cooler start for the summer this year, but right now it’s pretty hot for us in North Texas. Still, it's probably not a bad time to go somewhere even cooler in these last few weeks of the summer, a place like Europe where our U.S. dollar buys you more. Looking to the southern part of the Eurozone, great discounts are still available, whether you are considering a vacation there or investing in their markets which are crumbling like ancient architecture. But you won’t beat the heat. In this newsletter, we are going to spend most of our time reviewing last month's themes, as they truly still applied to July.

The default that launched 1,000 headlines